IN THIS ISSUE

💵 Funding Secured: Hermetica closes $1.7M seed round

🎥 Hermetica Hangout: Beyond

💰 USDh yield recap

📈 Weekly market review

Like what you see? Join our exclusive, ever-growing community on Discord and take part in future product launches:

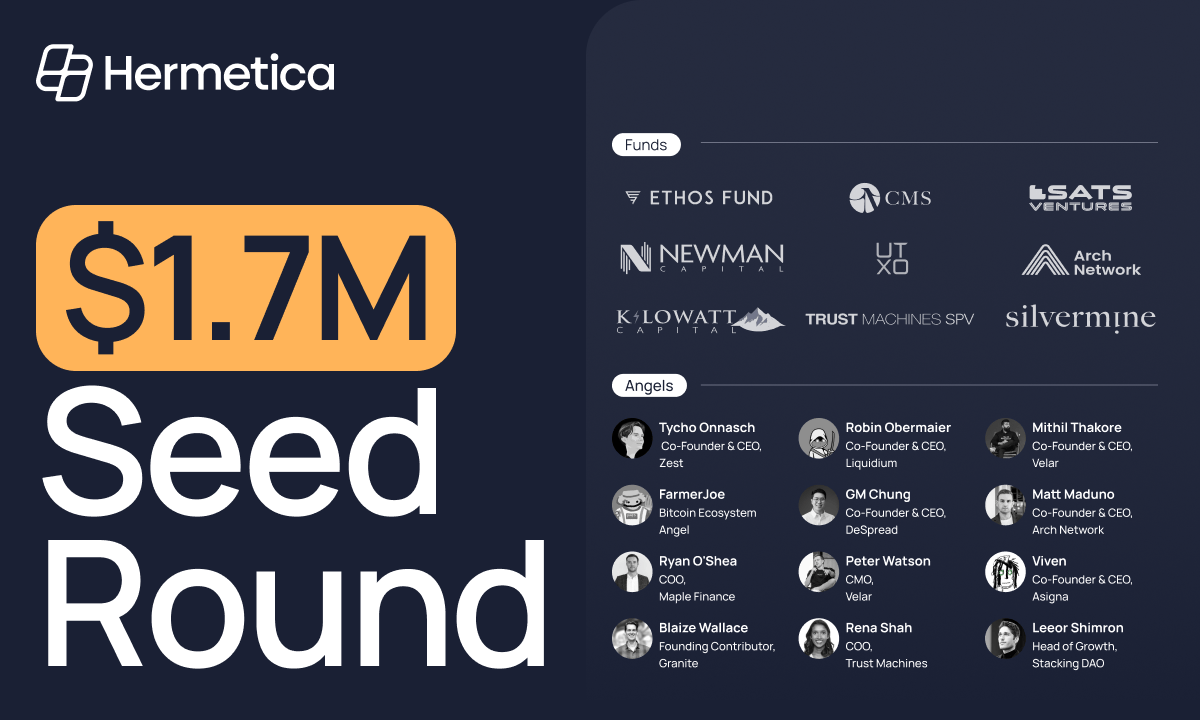

Funding Secured: Hermetica Closes $1.7M Seed Round

We’re excited to announce that we’ve successfully closed our $1.7 million seed funding round.

This investment will fuel our mission to make USDh, the first Bitcoin-backed yield-bearing stablecoin, accessible to all.

Our seed round garnered support from leading crypto investors such as UTXO Management, CMS Holdings, Ethos Fund, Trust Machines SPV, Kilowatt Capital, Newman Capital, and Silvermine.

We also received backing from strategic angels, including Tycho Onnasch (Founder & CEO of Zest Protocol), Robin Obermaier (Founder & CEO of Liquidium), Mithil Thakore (Founder & CEO of Velar), Matt Maduno (Founder & CEO of Arch Network), and GM Chung (Founder of DeSpread) and many others.

This is just the beginning; there is much more to come. Stay tuned as we continue to expand USDh’s reach and build innovative financial products that leverage Bitcoin’s security and transparency.

Read more in the article published by The Block:

Hermetica Hangout: Beyond

Another Hermetica Hangout took place on October 15 — did you see it? If not, we have you covered.

This week we sat down with Beyond to talk:

🔶 Tri-directional bridging

⛓️ Connecting 80+ chains seamlessly

💊 The Orange Pills Ordinal mint

Want to learn more? Check out the full recording on X:

ThThe next Hermetica Hangout will be here soon — set your calendars for October 29, follow the Hermetica X account, and turn on notifications so you don’t miss a thing.

USDh Yield Recap

Imagine consistently earning yield on your dollars. Well, now it’s a reality — this week sUSDh holders earned a 19% APY return.

Stake USDh so you can earn yield on your dollars too!

Market Review

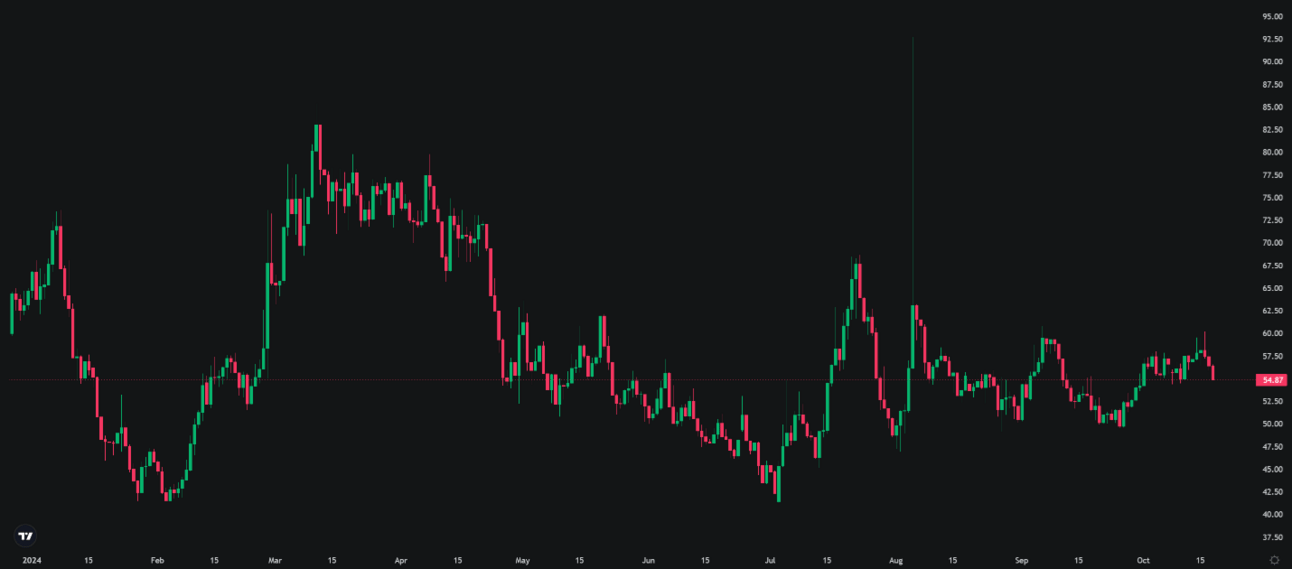

We saw a nice rally this week as Bitcoin reached $67,900.

[Figure 1: BTC Price 1 year; Daily Candles & Moving Averages]

The moving averages (MA) in Figure 1 are:

7-Day MA: $66,033

30-Day MA: $63,629

180-Day MA: $62,958

360-Day MA: $56,285

200-Week MA: $40,040

Bitcoin’s price is trading well above all moving averages (MAs), having decisively broken above the 180-day MA at $63,000 this week—an important move to re-establish a bullish trend. The MAs now signal a bullish stance.

Currently, Bitcoin is hovering near the July high. In just one week, it surged above all major MAs and is now approaching the critical $68,000 level. If it breaks and sustains above $68,000 on high volume for a week, we can confirm the end of Bitcoin’s 9-month downtrend. With this current structure, there’s roughly a 70% chance that prices will hit new all-time highs of $74,000 by year’s end.

On the upside, potential resistance levels include $68,000, $70,000, $72,000, and $74,000.

However, if the breakout fails, support is likely around $66,000, $64,000, $61,000, $60,000, $55,000, and $49,000.

Bitcoin returns are currently at:

1 month: -2.03%

3 months: -10.43%

6 months: -7.30%

12 months: +109.62%

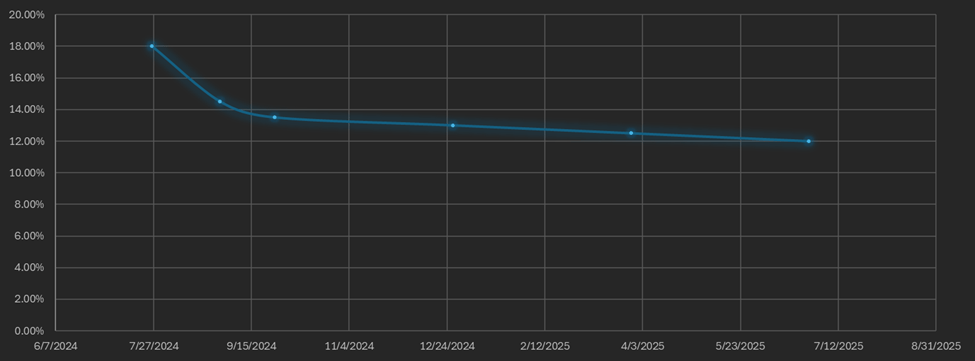

Bitcoin’s annual returns remain strong at 109.62%, even though prices have been in a downtrend for the past nine months. These high 1-year returns will persist until November 2023–February 2024, when last year’s peak prices fall out of the dataset.

Typically, periods of above-average returns are followed by periods of below-average performance. In Bitcoin’s case, traders are still benefiting from last year’s run-up. However, after nine months of underperformance and with the older high-return data rolling off, this metric is poised to turn bullish soon. Given the positive signals from other metrics and macroeconomic factors, the timing for this shift couldn’t be better.

Currently, the return signal is bearish to neutral but is expected to turn bullish by the end of November—unless a significant rally occurs sooner.

BTC ETF Flows

Net BTC ETF inflows since last Friday totaled $2.1095 billion, with average daily inflows of $421.9 million—marking a significant week for Bitcoin ETFs. This represents a 10x increase in Bitcoin purchases via ETFs compared to the previous week.

Two key factors are driving this surge in inflows. First, hedge funds are taking long positions in Bitcoin futures on the CME, while market makers sell those futures and buy Bitcoin ETFs to capitalize on the basis spread. Second, speculative retail demand has increased in response to recent price gains.

[Figure 2: Bitcoin ETF Flows; Daily Bars; Source: The Block]

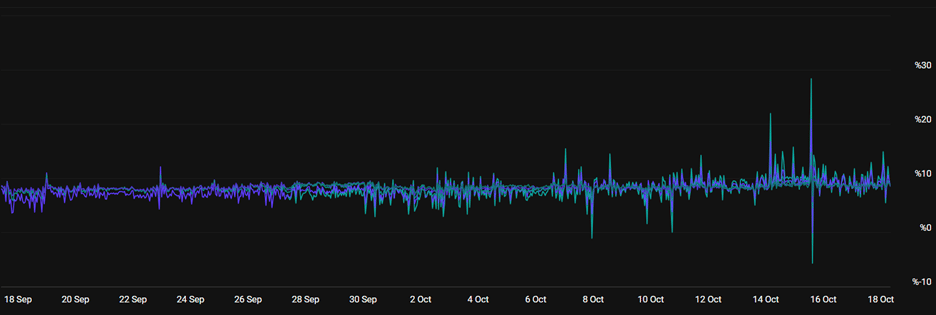

Volatility

Bitcoin's implied volatility (DVOL) currently stands at 54.87%, placing it in the 45th percentile. Despite Bitcoin nearing the upper boundary of its long-term bearish range, DVOL remains low. Market makers generally benefit from this scenario, as their short option positions move further out of the money. Surprisingly, DVOL has not increased in response to the recent rally.

This could indicate one of several things: there’s limited demand for options relative to market maker liquidity, market makers are net long delta and unphased by rising prices, or they expect a mean reversion with prices falling back toward the center of the long-term range.

To gain clarity, we need to examine other derivative metrics. The put/call ratio has risen, suggesting an uptick in put buying or selling. If traders were buying puts (possibly to hedge a spot position), market makers would typically short perpetual contracts to offset their risk. However, the opposite seems to be occurring—the futures curve suggests high demand, meaning market makers are likely buying futures or spot due to increased put selling.

This suggests there’s more liquidity in the Deribit options market than last week, and that market maker positioning isn’t the main factor behind the decline in DVOL.

[Figure 3: DVOL 1 Year; Bitcoin Index Price; Source: Deribit]

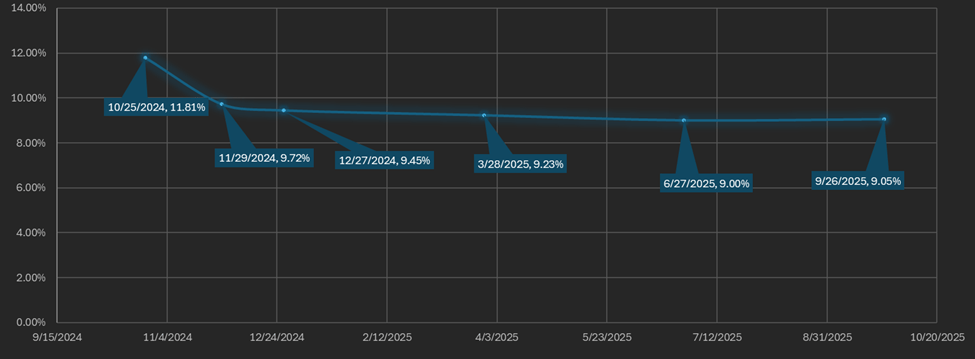

Basis Spread

The basis spread—the difference between the futures contract price and the spot price—is positive across all maturities. Over the past week, it has increased from 8.5% to around 9.5% on average, up from 7.5% just two weeks ago. This spread is now higher than it was two weeks ago when prices were at their peak.

Market participants are adding to their long futures positions as prices rise, which could be driven by market maker demand, as mentioned in the volatility section.

[Figure 4: Futures APR % over spot price 1 month; Source: Deribit]

The futures curve is showing an inverted contango starting from the front month (October 25th) onward. The annualized percentage return (APR) for the October 25th contract is higher than for all other maturities. The basis spread declines through June 2025, then slightly increases by September 2025. The difference between the lowest and highest yields across maturities is about 3%, but if the front month (October 25th) is excluded, the variation shrinks to less than 1%. This is the most bullish futures curve we've seen since early Q1 of this year.

[Figure 5: Futures Curve; Maturity Date, APR %]

Bullish Bitcoin futures curves are typically special inverted contangos (Figure 6) where front month has the highest APR, and APR falls every maturity thereafter, but APR is positive along the whole curve. This is exactly how the curve looks today.

This is the most bullish curve in the short term because market makers use front month as a substitute for perps and spot during periods of high demand.

[Figure 6: Example Bullish Futures Curve; Maturity Date, APR %]

Macro

A month ago, the Federal Reserve implemented its first 50-basis point (bp) cut in the Fed Funds Rate, the rate at which banks are incentivized to lend to each other overnight. Prior to the announcement, prediction markets placed the odds of a 50 bp cut at 53%, and a 25 bp cut at 47%. By opting for a 50 bp cut in a single meeting instead of a more cautious 25 bp, Fed Chair Powell signaled that he likely delayed the rate-cutting cycle too long. So far, markets—especially precious metals—have reacted positively to the cut, but this could reverse quickly if financial crisis or recession signals emerge in Q4. Historically, by the time the Fed begins cutting rates, deflationary pressures are already entrenched, making it difficult to avert a recession with mild monetary stimulus.

Other central banks have followed the US’s lead, beginning to ease monetary policy. On September 24th, China announced a stimulus package that took effect on October 7th, including a policy-rate cut, mortgage-rate reductions, and 800 billion yuan ($114 billion) in stock market support. This week, Chinese media reported that the government is considering issuing 6 trillion yuan in central government bonds to stimulate the economy through consumer handouts, local government refinancing, and 1 trillion yuan to recapitalize banks. The Hong Kong stock exchange surged 30% in a month, an impressive feat even by Bitcoin’s standards. This shift marks a significant change in China’s monetary and fiscal policy, which has been highly restrictive since 2020. As a result, Chinese easing is a major boost to global liquidity.

The US presidential election is two weeks away, and elections typically suppress positive price movements while increasing volatility in the lead-up. Fund managers often reduce risk ahead of such events by shrinking position sizes and holding more cash. Coupled with a reluctance to take risks near year-end to protect bonuses, election years tend to weigh on financial asset performance. However, once the election passes, sidelined capital usually floods back into markets, reducing volatility and driving prices higher.

Election markets have moved decisively in Trump’s favor in the last week, from approximately tied with Kamala Harris to a 60/40 spread. Considering Trump’s favorable position towards crypto this could be a contributing factor to Bitcoin’s positive performance this week, although not likely a major factor.

S&P 500 implied volatility (VIX) is currently at 19.20, while US Treasury implied volatility stands at 112.14. Both equity and bond volatility peaked last week and have since declined, marking a lower high on the daily timeframe. We expect volatility to remain stable until after the election, barring a major geopolitical event.

[Figure 7: VIX 1 Year; Daily Candles]

[Figure 8: Move Index 1 Year; Daily Candles]

Sincerely,

The Hermetica Team