- Hermetica

- Posts

- Weekly Update - October 17, 2025

Weekly Update - October 17, 2025

Earn BTC Yield for DeFi Deployment

IN THIS ISSUE

💸 Earn BTC Yield for DeFi deployment

⚙️ Starknet Glocks Up

🗞️ Q3 Crypto Industry Report

💰 USDh Yield Recap

☎️ Hermetica Hangout: Starknet

📈 Weekly Market Review

Like what you see? Follow us on X so you don’t miss any future announcements:

Earn BTC Yield for DeFi deployment

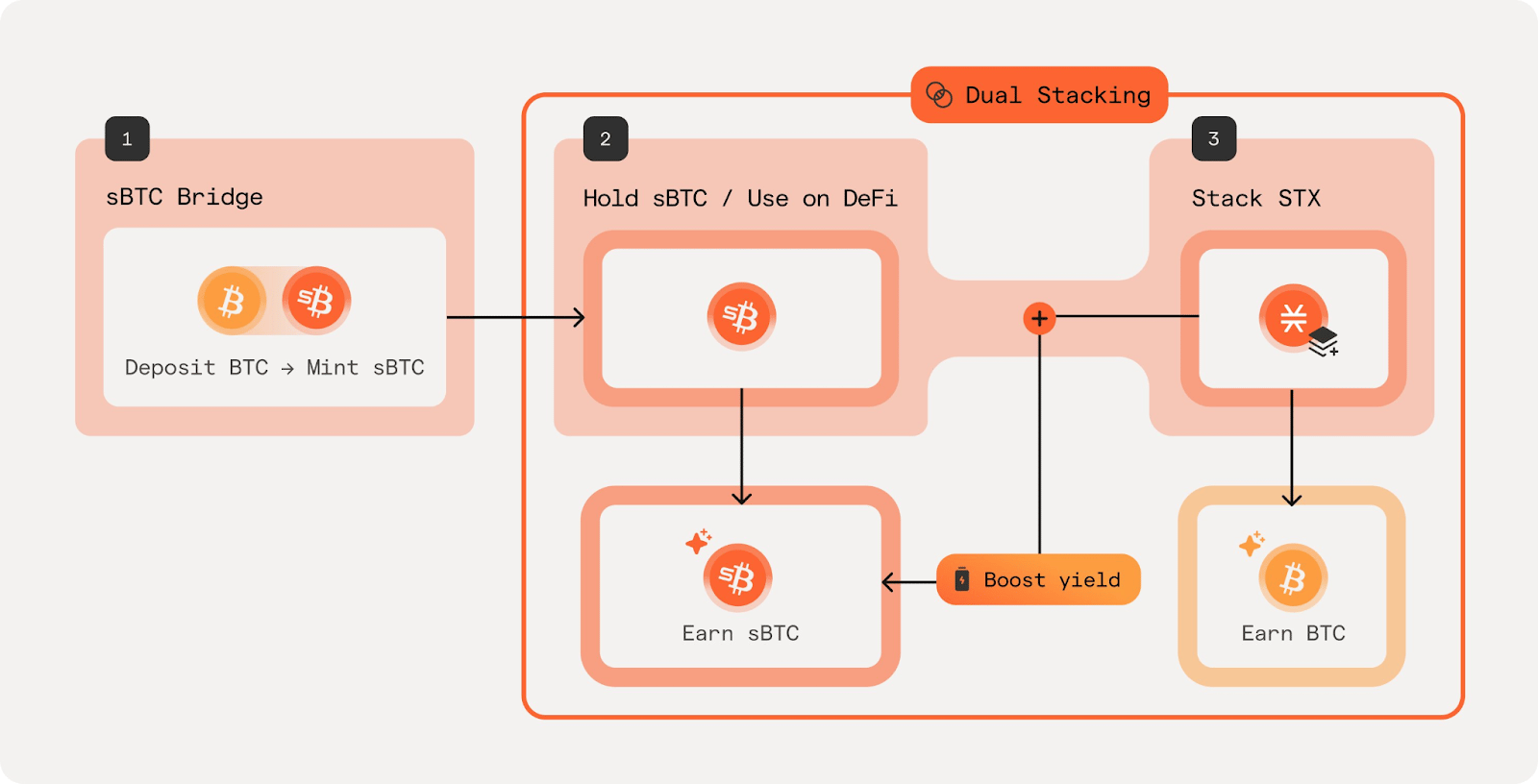

Stacks published the Dual Stacking Litepaper, outlining a new model for Bitcoin yield.

🔸 Earn a base yield for holding sBTC

🔸 Boost rewards by stacking STX alongside your sBTC

🔸 Deploy sBTC into DeFi on Stacks to earn the highest rewards

Rewards are paid directly in sBTC. Get ready to deploy.

Starknet Glocks Up

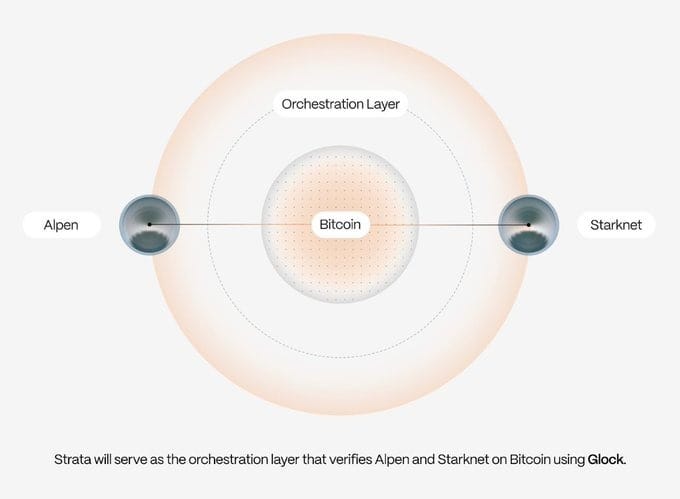

Starknet and Alpen Labs announced a new trust-minimized bridge between Bitcoin and DeFi.

Built on Alpen’s Glock verifier, it’s designed to make BTC movement verifiable without wrappers or middlemen. A Glock-powered bridge can lock BTC on Bitcoin and unlock it elsewhere only if provably burned, checked directly on Bitcoin.

A bridge with Bitcoin’s principles.

Q3 Crypto Industry Report

Total stablecoin market cap rose $44.5B to a new all-time high of $287.6B in Q3, according to CoinGecko’s Q3 2025 Industry Report.

Other Q3 Highlights:

🔸 Total crypto market cap rose +16.4% to $4.0T

🔸 ETH reached a new all-time high of $4,946

🔸 DeFi market cap grew +40.2%, regaining share over other sectors

🔸 DEX perp volume hit a record $1.8T quarter

USDh Yield Recap

If yields were trading cards, USDh would be that one friend who always pulls the shiny.

4% APY this week. 💎

Hermetica Hangout: Starknet

Next week, join us for a Hermetica Hangout with Starknet to discuss how they’re advancing trust-minimised bridges between Bitcoin and DeFi.

Set a reminder now.

Market Review

The largest single liquidation event in crypto history occurred on Friday, October 10th, with $19 billion liquidated in under 24 hours. Spot Bitcoin prices collapsed 15% in less than seven hours, while altcoins suffered even heavier losses. Ethereum fell 21% and Solana 24% on Binance, while order books in less liquid coins such as Cosmos (ATOM) were wiped out, briefly pushing prices to zero.

Tariff discussions between the U.S. and China likely contributed. President Trump’s announcement came after the U.S. market closed, limiting the impact on traditional markets.

Bitcoin dominance gained 0.33% for the week and 3.03% intraweek during the crash. Altcoin market caps dropped from $1.66T to $1.47T, hitting an intra-month low of $1.18T on Friday.

DVOL: 49.04%

Average equal-weighted futures basis spread: 5.06% APR

Futures curve: steepened and normalized; front contracts declined

Perpetual futures funding rates: declined briefly to near zero

Funding rates: peaked at 72% on Friday

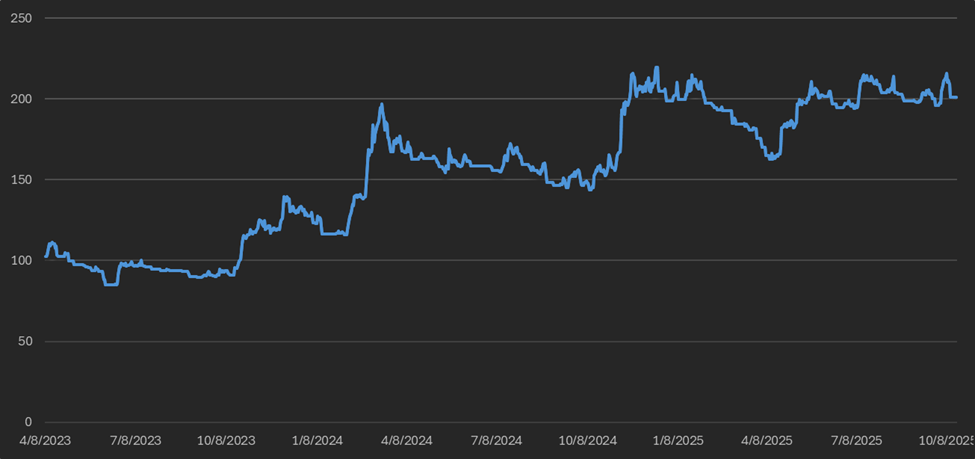

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $108,700

7-Day MA: $111,600

30-Day MA: $115,400

180-Day MA: $110,200

360-Day MA: $100,500

200-Week MA: $54,000

Bitcoin slipped below the 7-day, 30-day, and 180-day moving average (MAs) and is now in a downtrend.

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend following portfolio are down 6.37% from January’s ATH. The portfolio dropped on Friday afternoon, and was turned off following the liquidation event.

Low liquidity left Bitcoin exposed to sharp sell-offs late last week. In such conditions, random price swings can trigger false buy or sell signals in quantitative systems.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

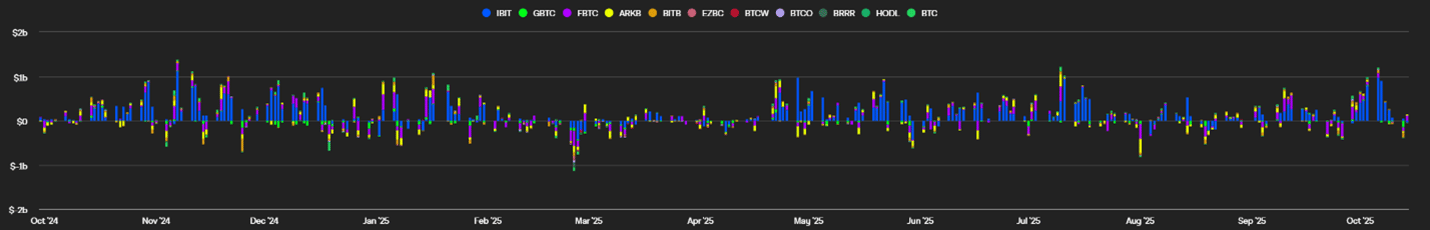

BTC ETF Flows

Net outflows hit an all-time high of $3.7B this week. ETF inflows reached record levels of $3.7B last week, and $1.83B the week before.

Figure 5: Bitcoin ETF Flows, Daily Bars; Source: The Block

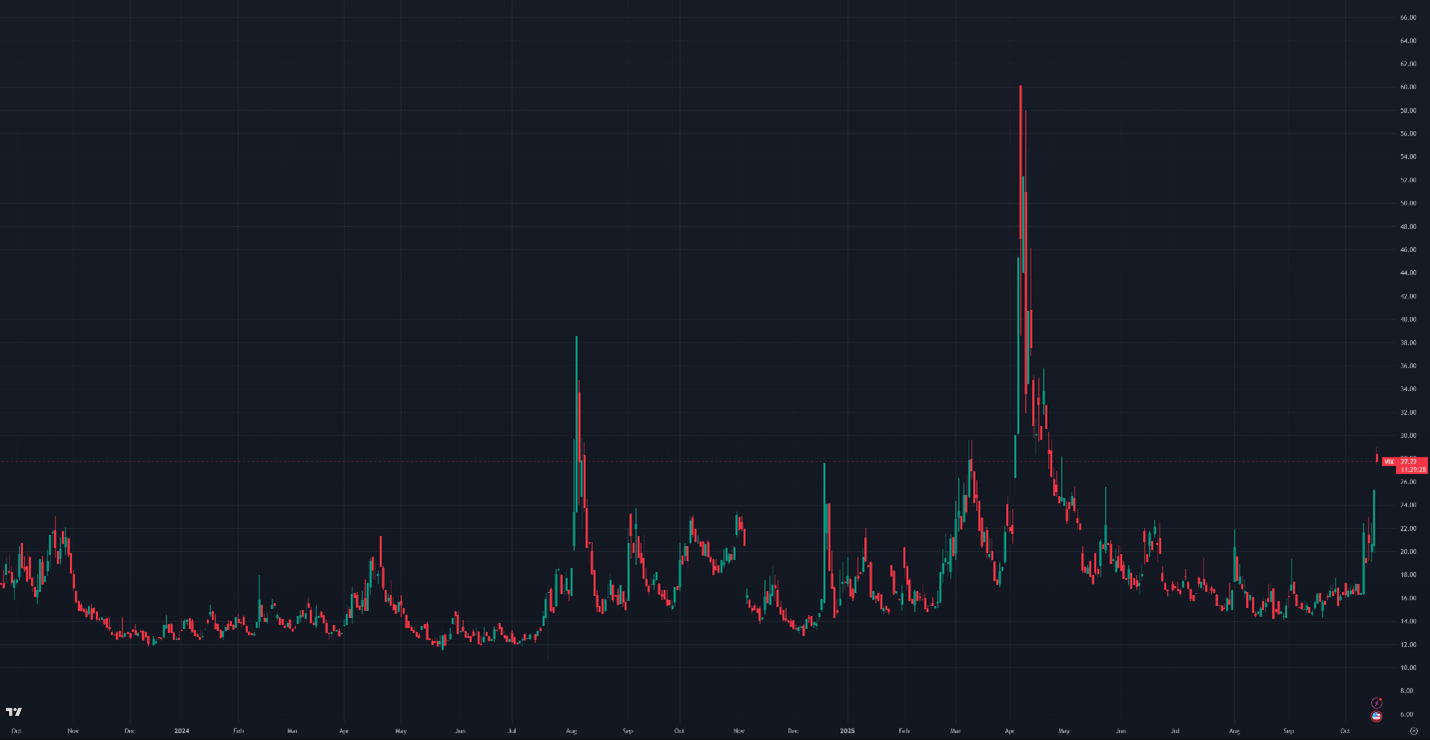

olatility

The crash last week elevated Bitcoin’s implied volatility (DVOL) to 49.04%, up from 39.88% the previous week.

Market makers hedge in the Deribit options market because TradFi Bitcoin products, such as BTC ETFs and Bitcoin portfolio companies, sell call options for yield. This strategy places systematic downward pressure on options prices and implied volatility.

Figure 6: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

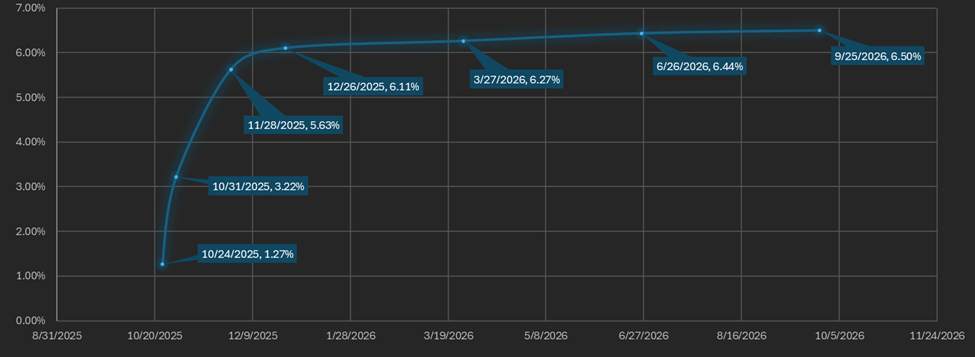

Basis Spread

The basis spread is positive across all maturities. The average-weighted basis spread fell from 7.45% APR to 5.23% APR week-over-week.

The futures curve is in a normal contango with front month trading below later maturations. The spread between the lowest and highest yielding maturity rose from a comparatively flat 1.11% to 5.23%. This is one of the rare instances where the spread between APRs exceeds the average equal-weighted APR.

Figure 7: Futures Curve; Maturity Date, APR %

Macro

Last Friday, October 10th, President Trump announced potential retaliatory tariffs on China. PresidentTrump has since stated he is willing to discuss the export caps with President Xi at the APEC forum on October 31st.

The Dollar Index ($DXY), which measures the U.S. dollar against a basket of other currencies, is 98.28 as of Thursday evening after reaching a three-year low of 96.25 on September 17th. Thirty-year bond yields are slightly lower at 4.58%. Gold and silver prices reached record highs of $4,379.00 and $54.49 per ounce, respectively.

U.S. Treasury bond implied volatility (MOVE) remains near its long-term steady state, while equity market implied volatility (VIX) has spiked 69% since last Friday and moved off its steady-state level. The VIX rose to 27.72% from 20.8% last week, while the interest rate–adjusted MOVE index (MOVE Index / 10-Year Treasury Bond Yield) remains slightly above its multi-year low at 18.22%.

Figure 8: VIX, Daily Candles; 2 Years

Figure 9: Move Index/US10Y, Daily Candles; 2 Years

Sincerely,

The Hermetica Team