- Hermetica

- Posts

- Weekly Update - November 28, 2025

Weekly Update - November 28, 2025

Bitcoin’s Trillion Dollar Blind Spot

IN THIS ISSUE

🔓 Bitcoin’s Trillion Dollar Blind Spot

🏦 BTC as a State Reserve Asset

💰 USDh Yield Recap

📈 Weekly Market Review

Jakob TL;DR

Jakob here. Every week, Bitcoin sees more adoption, and naturally, that comes with a growing pull toward earning in BTCfi. Here’s what caught my attention this week.

A report from Redstone shows only 8% to 11% of crypto capital earns yield, while more than half of TradFi capital does. Bitcoin sits dominant, with few paths to yield (but that changes soon)

Texas becomes the first U.S. state to execute a Bitcoin reserve, with New Hampshire and Arizona making similar progress

Bitcoin’s Trillion Dollar Blind Spot

Crypto is now a $3.2T economy, but only 8-11% of those assets earn any yield. In traditional finance, 55–65% of capital sits in yield-bearing products. Where TradFi is yield-driven, crypto is still appreciation-driven.

At the center sits Bitcoin, largely unproductive; a trillion-dollar blind spot.

Institutional investors are starting to push in the opposite direction. A recent Redstone report shows on-chain finance evolving from speculative trading into financial infrastructure. ETH, for example, added ~$34B in notional value between 2023 and today through liquid staking alone.

So why is Bitcoin, a $1.8T asset, still mostly idle? There aren’t Bitcoin yield products built to the Bitcoin standard. That changes this winter: BTC-in/out and entirely on-chain.

If you’re ready to make your Bitcoin productive, let us know.

BTC as a State Reserve Asset

Texas took its first real step toward a state Bitcoin reserve, purchasing $5M of BlackRock’s spot Bitcoin ETF as a temporary allocation while it finalizes infrastructure for direct, self-custodied BTC.

The legislature already approved $10M for the Texas Strategic Bitcoin Reserve. Texas is on track to become the first U.S. state to directly hold Bitcoin as a long-term reserve asset, not just via pension funds or proxy exposure.

New Hampshire and Arizona are building similar reserves. States are showing what they want to hold on their balance sheets, and increasingly, the answer is Bitcoin.

Public treasuries now treat Bitcoin less like a trade and more like money. Soon they’ll realize it’s the hardest asset there is.

USDh Yield Recap

Consistent yield is rare.

Sustainable yield more so.

Guess who checks both boxes?

Market Review

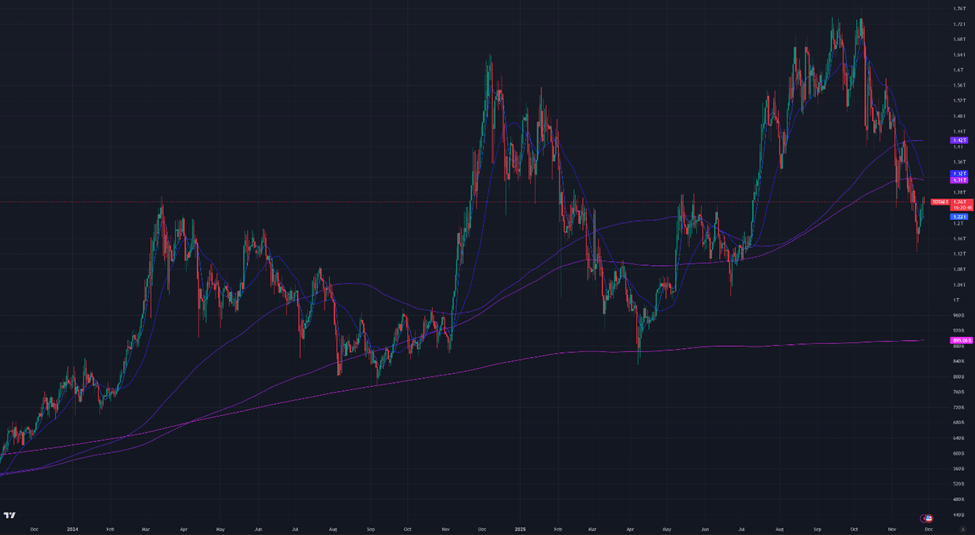

Bitcoin is trading near $92,000 from $80,000 last week. US public markets closed on Thursday for Thanksgiving. Trading activity is often lighter around holidays, and lower liquidity can lead to larger price moves. Equities have also rebounded from recent lows, though most have not retaken prior highs.

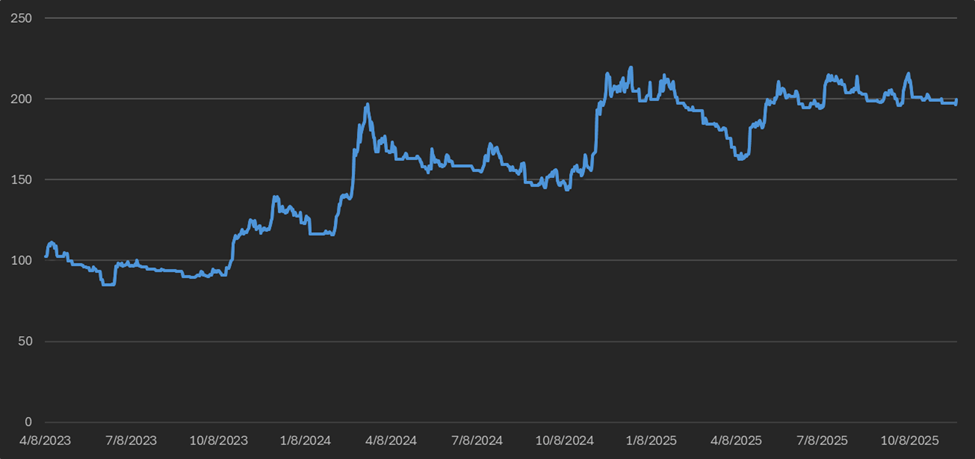

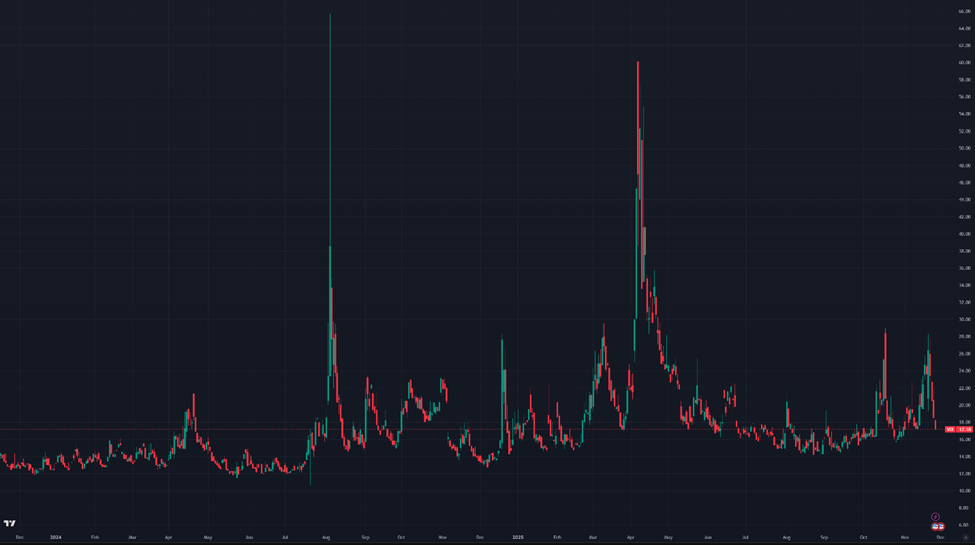

Across altcoins, the aggregated market cap rose from roughly $1.17T to $1.26T. Bitcoin dominance increased by 0.25% this week after falling more than 1.3% over the previous two weeks.

Data Summary:

DVOL: 49.77%

Equal-weighted futures basis spread: 5.1% APR

Futures curve is steep and largely unchanged from last week

Perp funding rates remain near zero with occasional negative dips

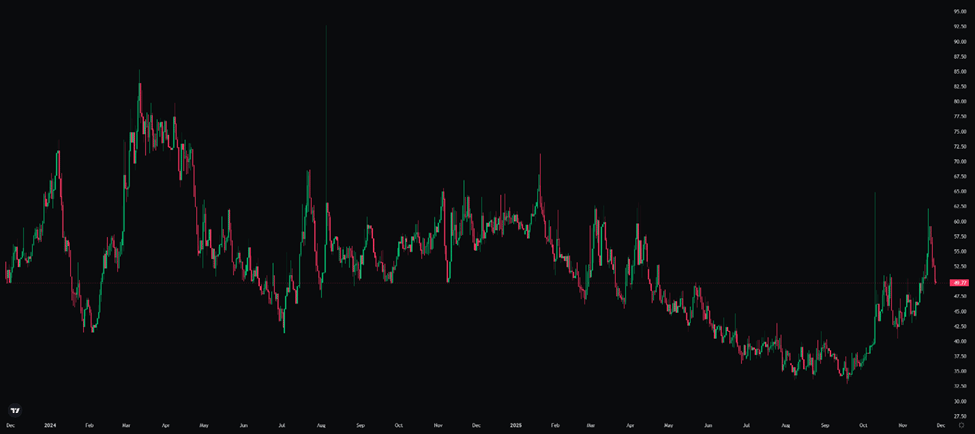

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $91,400

7-Day MA: $87,800

30-Day MA: $98,200

180-Day MA: $110,300

360-Day MA: $102,600

200-Week MA: $55,600

Bitcoin is trading below its 30-day, 180-day, and 360-day moving averages, while remaining above the 7-day MA. The price trend is still downward, and the longer moving averages are converging toward spot.

Bitcoin has cleared most short and medium-term moving averages, leaving little MA support until the 200-week MA near $55,000, which has historically marked cycle bottoms. The current price near $91,000 is a support zone, with additional support below at $76,000 and $60,000.

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend following portfolio are down 6.99% from January’s ATH. The portfolio entered its first position in two weeks on November 26 and is up about 1% since entry. Since the October drawdown, the strategy has reactivated six times, recording small losses on five of those entries; the latest trade is the only one currently positive.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

BTC ETF Flows

Net inflows totaled $237M this week. U.S. markets were closed on Thursday for Thanksgiving, which suppressed flows.

Figure 5: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) contracted over the past week as prices recovered. Current DVOL is 49.77% after rising to 62.5% last Friday. Since the October drawdown, volatility has been range-bound between the low 50% and the low 40%. That range briefly broke when Bitcoin dropped below $90,000 last week, but volatility has now returned.

Implied volatility reached a two-year low in September. The subsequent selloff coincided with thinner options liquidity and a sharp rise in volatility, pushing it into the current range and breaking the longer-term decline that had persisted for the past 18 months.

Volatility has trended lower alongside increasing market-maker hedging activity tied to Bitcoin-linked products such as ETFs, treasury companies, and miners.

Figure 6: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

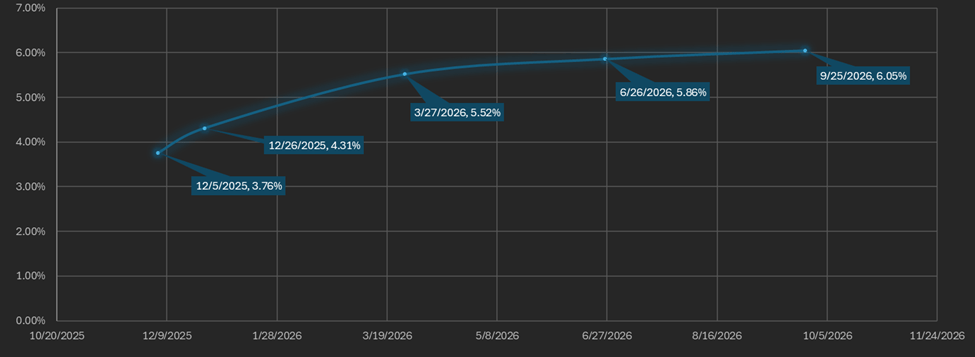

Basis Spread

The basis spread, or the price of a futures contract over its spot price, is positive across most maturities except the front-week November 21 contract. The average (equal-weighted) basis spread fell slightly from 3.49% APR to 3.39% APR week-over-week.

The futures curve remains in normal contango, with the front month (November 28) trading below later maturities. The spread between the lowest- and highest-yielding maturities narrowed from 5.83% to 5.03%. This change reflects a less negative front-weekly contract and a decline of more than 0.5% at the long end for the second consecutive week.

Figure 7: Futures Curve; Maturity Date, APR %

Macro

On October 30, the Federal Reserve held its seventh FOMC meeting of the year, where Chair Jerome Powell cut the federal funds rate by 25 bps to a 3.75%–4% range and ended the Fed’s quantitative tightening program.

Markets have also been digesting the role of leveraged Treasury cash-futures basis trades. Recent analysis shows that roughly 40% of Treasury purchases in the past few years came from highly leveraged cash-futures basis traders. These traders borrow at short-term bills and short futures of the same duration, capturing the positive basis spread. Earlier this month, SOMA manager Roberto Perli said reserves are no longer “abundant.”

System liquidity has been reduced by quantitative tightening, impacts of the US shutdown, and a higher Treasury General Account (TGA) balance. Further tightening would raise financing pressure on leveraged basis positions and could amplify moves in Treasury yields and short-term funding rates.

Market risk sentiment appears to have improved after de-risking over the last few weeks. The Dollar Index (DXY) has trended higher since mid-September and now sits at 99.66. 30-year bond yields are down to 4.64%. U.S. stocks are still down 1.55% from October highs, with the declines coming largely from AI stocks. The VIX fell from 26.51% to a near steady-state level of 17.18%, while interest rate–adjusted MOVE index (MOVE Index / 10-Year Treasury Bond Yield) fell from 19.14% to 18.01% over the past week.

Figure 8: VIX, Daily Candles; 2 Years

Figure 9: Move Index/US10Y, Daily Candles; 2 Years

Sincerely,

The Hermetica Team