IN THIS ISSUE

🪙 What’s Next for Bitcoin?

🏦 Bitcoin on the State Balance Sheet

💰 USDh Yield Recap

📈 Weekly Market Review

What’s Next for Bitcoin?

Bitcoin is quietly maturing. You can see it on-chain, in ETF positioning, and now at the checkout counter.

Long-dormant “whale” wallets are selling into institutional bids. As of Q3 2025, 172 public companies hold over 1M BTC (around $117B), with the number of firms up nearly 40% quarter-on-quarter.

Bitcoin is migrating into balance sheets, custodians, and structured products.

As that happens, volatility tightens. Bitcoin’s realized volatility has been near decade lows even as price makes new highs. ETF desks harvest steady yield by selling calls.

This is textbook financialization: an asset is first securitized, then collateralized, and eventually turned into a yield engine.

Financialization has moved beyond markets and into payments. Square now lets millions of U.S. merchants accept Bitcoin with zero processing fees, while Cash App routes instant BTC payments over Lightning, even when users spend dollars. A merchant can run their front-of-house in fiat, end each day with surplus BTC on the balance sheet, and never touch an exchange.

Once Bitcoin shows up in P&L, CFOs ask the obvious question: What yield can I earn on this?

Institutions are already asking it.

A Bitwise study estimates institutional flows into Bitcoin could reach roughly $400B+ billion by 2026 (~4M BTC, or ~20% of total supply). It’s not only institutions moving beyond the pure “number go up” phase. With volatility capped by ETF products and fewer swings expected, retail BTC holders also want structured, Bitcoin-denominated yield.

Here’s the catch: Legacy products often pay rewards in volatile tokens instead of Bitcoin, and remain opaque and hard to audit.

Meet hBTC. Bitcoin yield made easy. A keystone of Bitcoin DeFi and a clear example of how BTCfi should work. hBTC wraps the same institutional-grade strategies (basis arbitrage, collateralized lending, staking, etc.) into a tokenized product that pays yield in Bitcoin, is non-custodial, and offers real-time transparency.

Bitcoin is graduating into a global yield market. If you want your BTC working for you, the only way to get exclusive access to hBTC is through the waitlist. Subscribe now.

Bitcoin on the State Balance Sheet

Day one of Bitcoin Amsterdam opened with a clear signal: Europe isn’t just talking about Bitcoin anymore, governments are putting it on the books.

Luxembourg’s sovereign wealth fund is allocating 1% of its assets to BTC, while the Czech National Bank has launched a test portfolio of digital assets, mostly Bitcoin.

Nation-states in the EU are now treating Bitcoin as a strategic reserve asset. Governments, treasuries, and financial institutions will all be asking the same question: How do we make this Bitcoin productive?

That’s exactly what hBTC is built for.

USDh Yield Recap

Traders speculate. USDh stakers accumulate.

USDh yield: 5% APY

Still think stablecoins can’t earn? 👀

Market Review

Bitcoin price is near $95,000, down over 25% from last month’s all-time high. Altcoin market caps fell from $1.34T to $1.31T. Bitcoin dominance decreased by 0.7%, ending its five-week streak of consecutive gains.

DVOL: 48.83%

Equal-weighted futures basis spread: 3.49% APR

Futures curve: steep and largely unchanged from last week

Perp funding rates remain near zero with occasional negative dips

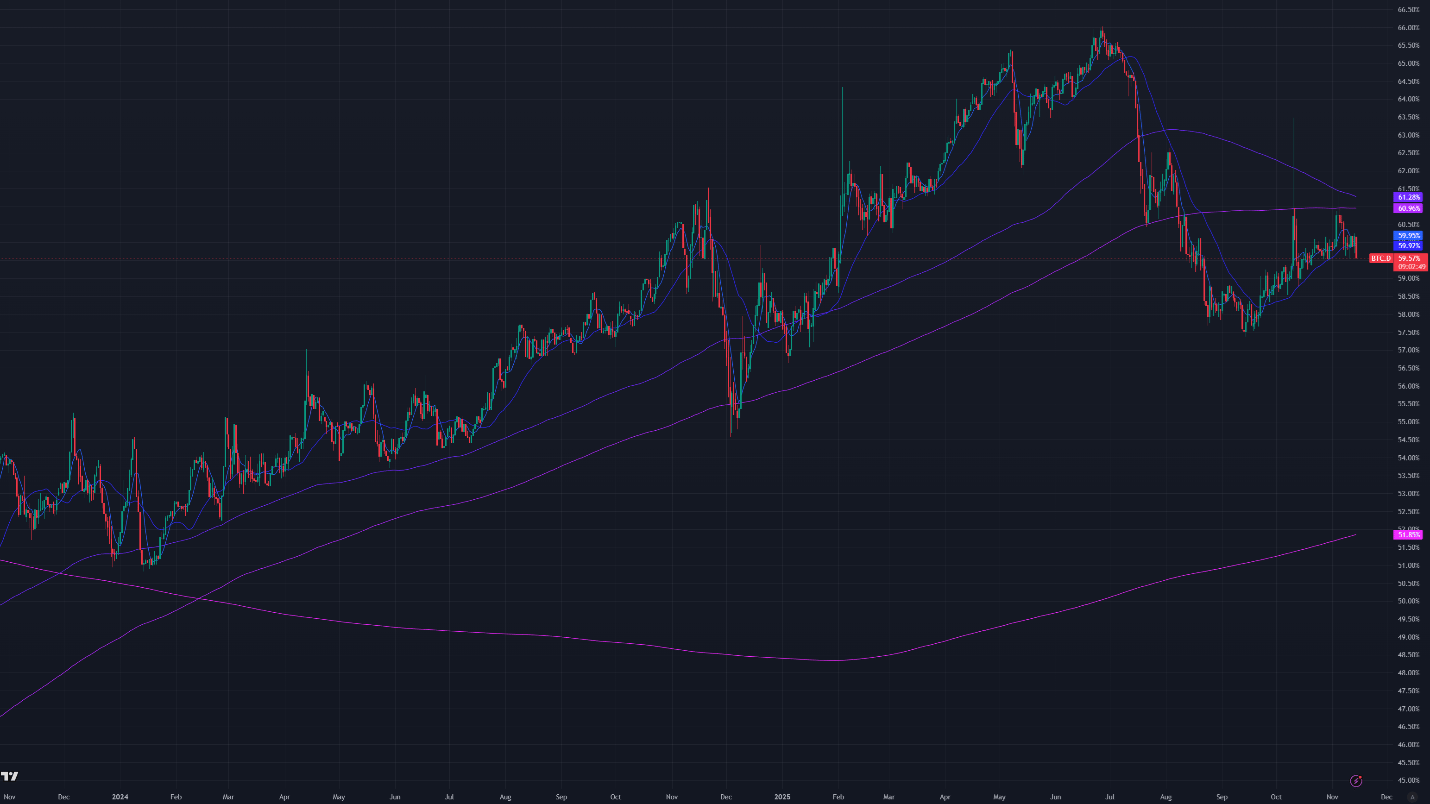

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $96,500

7-Day MA: $102,000

30-Day MA: $107,000

180-Day MA: $111,600

360-Day MA: $102,800

200-Week MA: $55,200

Bitcoin is below the 7-day, 30-day, 180-day, and 360-day moving averages. Price is in a downtrend, but the MAs lag behind spot price. Bitcoin has cleared all short- and medium-term MAs. The next major support is the 200-week MA at $55,000, which has historically marked cycle bottoms. Above this major level, the interim support zones established by previous liquidity are $95,000, $84,000, $76,000, and $60,000.

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend-following portfolio are down 8.09% from January’s ATH. The portfolio took its first trade in over a week on November 11 but closed it for a loss. The portfolio has reactivated 5 times since the crash in October and has taken a loss each time.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

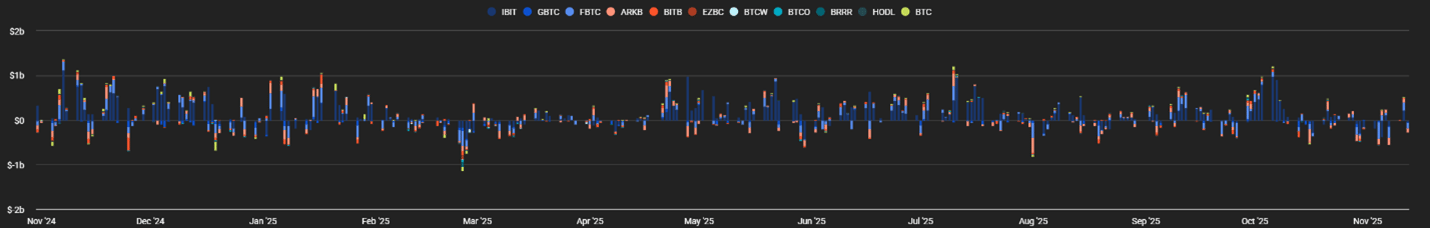

BTC ETF Flows

Net outflows were $1.178B this week, marking the fifth consecutive week of outflows.

Figure 5: Bitcoin ETF Flows, Daily Bars; Source: The Block

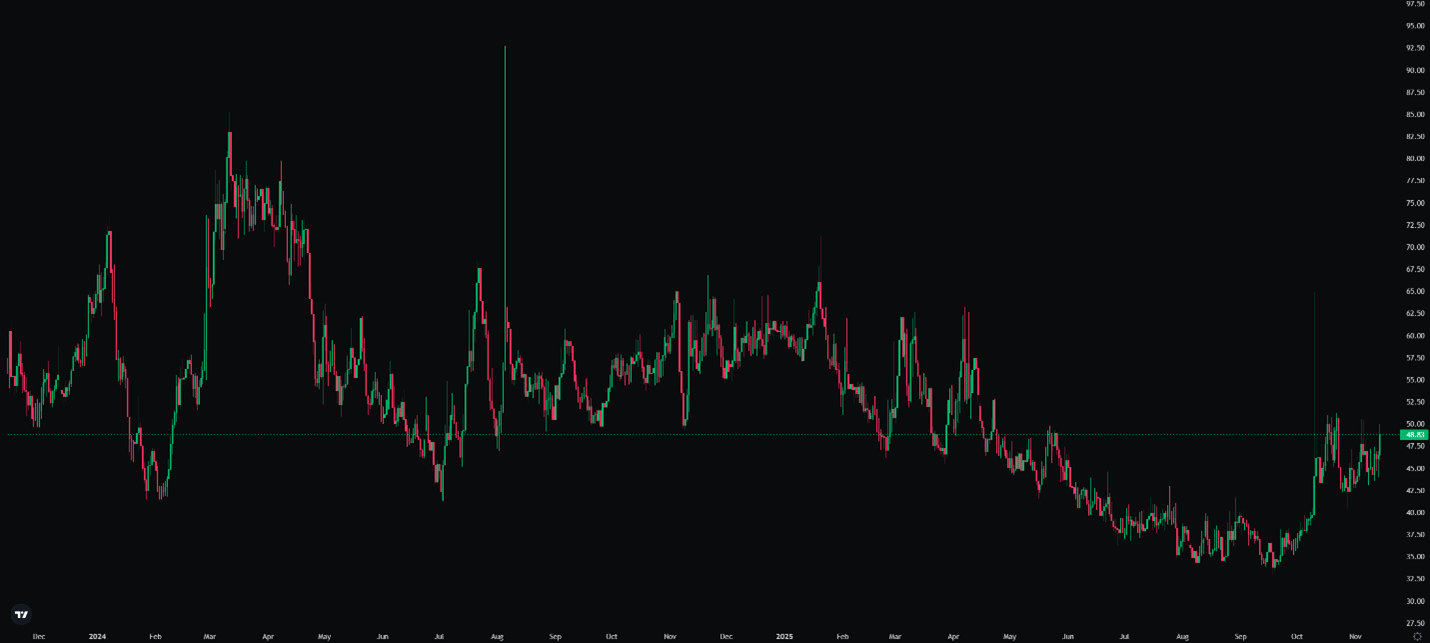

Volatility

Bitcoin's implied volatility (DVOL) is currently high at 48.83%, having briefly peaked above 50% yesterday.

This recent volatility contradicts the broader, 18-month-long trend of declining volatility with 2-year lows recorded in late September.

That downtrend can be attributed to options hedging activities by market makers on various Bitcoin products, including ETFs, treasury companies, and miners.

Figure 6: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

Basis Spread

The basis spread, or the price of a futures contract over its spot price, is positive across most maturities except the front week November 21 contract. The average (equal weighted) basis spread declined from 3.59% APR to 3.49% APR week-over-week.

The futures curve is in normal contango, with the front month (November 28) trading below later maturities. The spread between the lowest and highest maturities fell from 7.39% to 5.83%. The compression was caused by the front weekly contract becoming less negative and a drop of more than 0.5% in the long-end maturities.

Figure 7: Futures Curve; Maturity Date, APR %

Macro

On October 30, the Federal Reserve held its seventh FOMC meeting of the year, where Chair Jerome Powell cut the federal funds rate by 25 bps to 3.75%–4% and ended the Fed’s quantitative tightening program. Powell stated in his press conference that a December 10 rate cut is not guaranteed.

Recent Treasury auction results have drawn attention. It was revealed that roughly 40% of Treasury purchases in the past few years came from highly leveraged basis traders, who borrow at short-term rates to buy longer-duration bonds and pocket the spread. Powell referenced “liquidity tightening” and “firming repo rates” at the last meeting, before this information became public.

On November 12, Roberto Perli, head of the Fed’s System Open Market Account, warned that “reserves are no longer abundant.” A day later, the New York Fed published a chart showing hedge funds’ use of repo borrowing.

Figure 8: The Size and Growth of Hedge Funds, Federal Reserve Bank of New York

If market liquidity tightens, basis traders may be forced to unwind their positions, leading to a sharp rise in Treasury yields. Higher yields would, in turn, put pressure on banks holding long-duration bonds and could trigger insolvencies similar to those seen in the 2023 U.S. regional banking crisis.

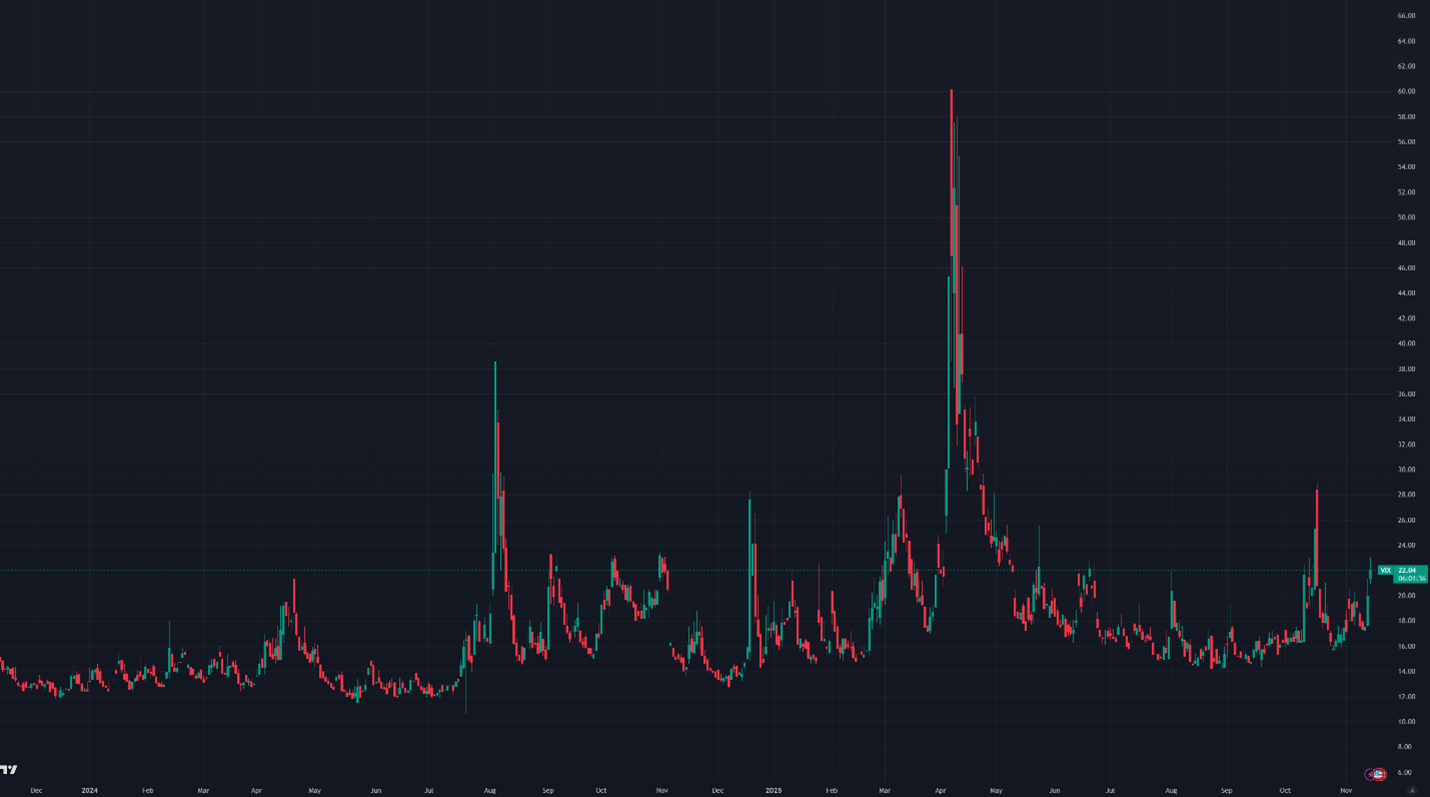

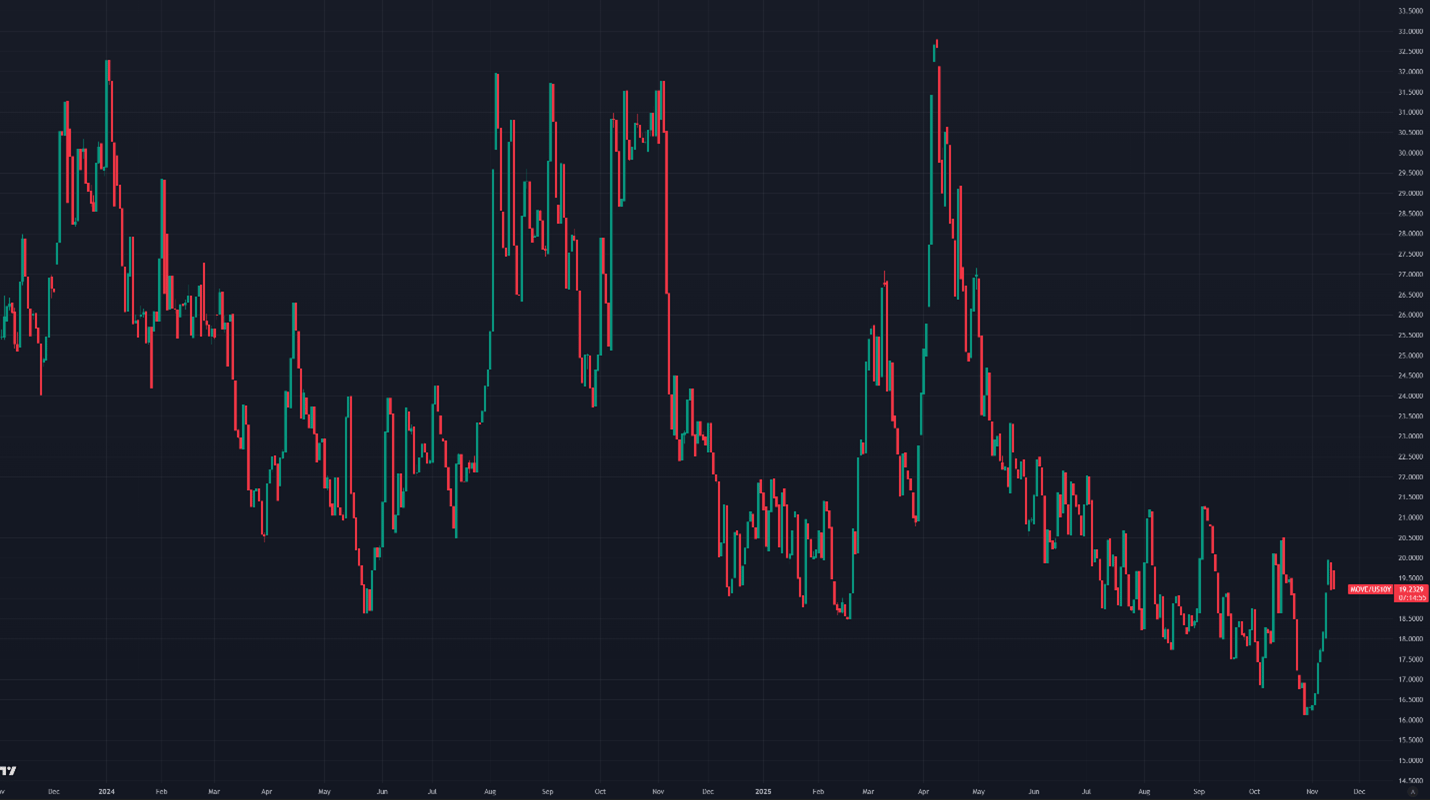

The dollar index has trended higher since mid-September and now sits at 99.27. 30-year bond yields went up from 4.71% to 4.73%. U.S. equities are down roughly 2.5% from their October highs, driven largely by weakness in AI-linked stocks. Market volatility has also increased: the VIX climbed from 19.69% to 22.04%, while the interest-rate-adjusted MOVE index (MOVE index divided by the 10-year Treasury yield) rose from 17.64% last week to 19.23% today.

Figure 9: VIX, Daily Candles; 2 Years

Figure 10: Move Index/US10Y, Daily Candles; 2 Years

Sincerely,

The Hermetica Team