IN THIS ISSUE

🎙️ Jakob talks USDh live

🛡️ Custodian attestations: June 2025

🗳️ SIP-031 voting open

💰 USDh yield recap

☎️ Hermetica Hangout: BOB

📈 Weekly market review

Like what you see? Follow us on X so you don’t miss any future announcements:

Jakob Talks USDh Live

Jakob, our Founder and CEO joined the Crunching Sats stream this week for a deep dive into the mechanics behind USDh.

He walked through Hermetica’s dashboards, breaking down how we visualize backing, APY, and reserve health in real time.

Watch the recording to learn how we’re scaling transparent yield on Bitcoin.

Custodian Attestations: June 2025

USDh’s June 2025 attestation is now live.

We’re sharing our latest attestation report from all integrated custodians, confirming that USDh’s backing assets are securely held off-exchange in institutional custody.

In summary, as of the snapshot time:

USDh supply: $5,524,679.74

Copper custodied assets: $3,326,746.76

Ceffu custodied assets: $1,971,300.00

Redeeming Reserve Stacks: $221,668.34

Redeeming Reserve Ethereum: $5,715.85

Total backing assets: $5,525,430.95

Reserve Fund: $60,240.60

USDC: $50,149.59

USDh: $10,091.01

Total % of USDh: 100.92%

SIP-031 Voting Open

The Stacks Improvement Proposal 031 is now live for voting.

SIP-031 introduces a long-term growth endowment to accelerate adoption across the Stacks ecosystem by funding builders and scaling impact sustainably.

Voting is open until July 9. STX holders can help shape the future of Stacks by casting their vote on-chain.

USDh Yield Recap

This week USDh printed 3% APY.

If your wallet was a gym, USDh would be ripped and shredded because it showed up every single day.

Hermetica Hangout: BOB

This week, we hosted BOB for a discussion on Bitcoin layers, hybrid L2s, and how BOB is bridging the gap between Ethereum and Bitcoin. If you missed the session, catch the recording here.

Next week, stay tuned for another exciting session as we continue spotlighting projects building across BTCFi. Set a reminder so you don’t miss out.

Market Review

Bitcoin recovered on Monday as tensions eased in the Middle East. After an initial $4,000 rally, price has stalled again and may be forming a third lower high since the all-time high on May 22nd.

DVOL collapsed to 37.93 following the ceasefire, marking the lowest implied volatility in 21 months.

Futures basis spreads remain low despite an uptick in the front-week contract.

The futures curve is in a normal contango (except for the front week, which is elevated), with the average equal-weighted basis spread flat week-over-week at 5.3%. When the front end of the curve is below more distant maturities, as it is now, this signals weak spot demand.

Perpetual futures (perps) funding rates turned positive immediately after the ceasefire and remained so through Wednesday and most of Thursday.

Aggregated altcoin market caps declined slightly from $1.13T to $1.11T. Bitcoin dominance rose 1% this week, reaching new multi-year highs not seen since January 2021.

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $107,350

7-Day MA: $105,160

30-Day MA: $105,500

180-Day MA: $95,840

360-Day MA: $83,970

200-Week MA: : $49,100

Bitcoin has moved back above all short-term moving averages (MAs) after tensions in the Middle East cooled earlier this week. Uptrends typically persist as long as price does not remain below both short-term MAs for more than a few days.

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend following portfolio are now down 8.45% from January’s all-time high. Two months ago, the portfolio was down 22.99%, the largest drawdown for long-oriented trend strategies since late 2024, when losses reached nearly 25%. These strategies recovered following easing US–China trade tensions, but were caught off guard by last week’s geopolitical shock in the Middle East.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

BTC ETF Flows

Net outflows this week were $1.72 billion, an increase of $380.3 million compared to last week. Bitcoin ETFs have seen over $1 billion in net inflows over the past three weeks. Demand for Bitcoin allocations in TradFi remains strong, though price action has not responded as positively as these inflows might suggest.

Figure 5: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

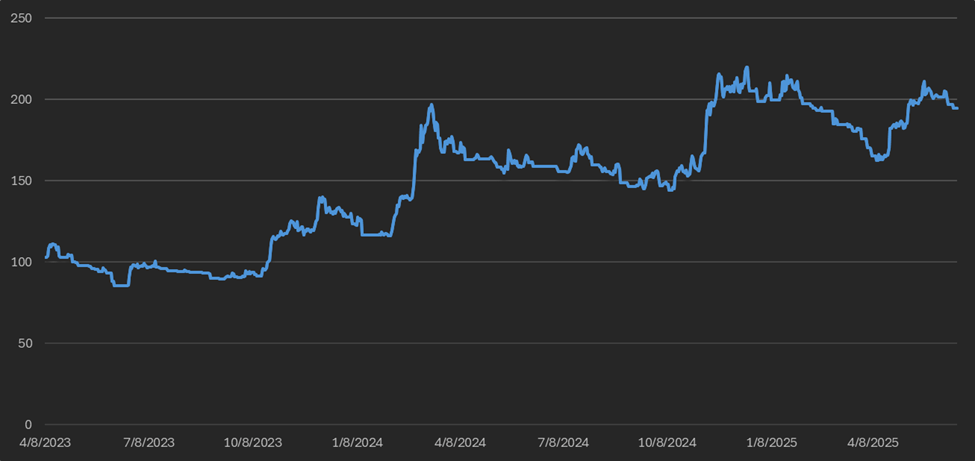

Bitcoin’s implied volatility (DVOL) currently sits at 37.93%, its lowest level since October 2023. Low implied volatility indicates weak demand for derivatives leverage and a reduced need for market maker hedging activity. The recent decline from a weekend high of 44.6 followed the de-escalation in the Middle East and continues a broader long-term downtrend in Bitcoin implied volatility.

Figure 6: DVOL 1 Year; Bitcoin Index Price; Source: Deribit

Basis Spread

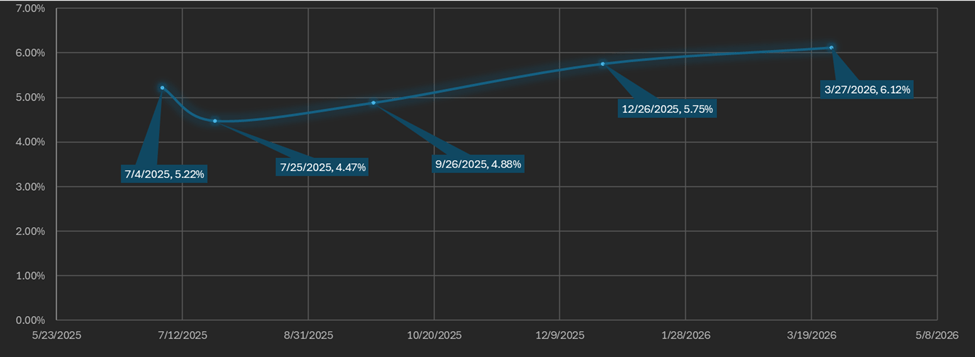

The basis spread, or the price difference between futures contracts and their spot equivalent, remains positive across all maturities. The average (equal-weighted) basis spread was nearly flat this week, declining slightly from 5.30% APR to 5.29% APR. However, it remains down 3.85 APR, or 42%, from the peak recorded one month ago.

The futures curve is in a normal contango, with the front month contract (July 25th) yielding 4.47% APR and maturities rising steadily to 6.12% APR for the March 2026 contract. The front week contract (June 4th) stands out at 5.22%, higher than both the July and September contracts. Excluding that, the curve slopes upward with duration. The spread between the lowest and highest yielding maturities is 1.64%, down from 3.77% last week.

Figure 7: Futures Curve; Maturity Date, APR %

Market makers frequently utilize front contracts to hedge short-duration instruments such as front-week/month options, perps, and spot holdings. This enables them to manage larger books while maintaining delta neutrality. A higher yield on front maturities relative to longer-dated ones typically indicates stronger near-term market positioning.

A futures curve that slopes downward from the front indicates strong demand for near-term maturities relative to available supply, often seen during periods of heightened spot interest. The January futures curve (Figure 8) is an example of this structure.

Figure 8: Futures Curve Bullish Example; Maturity Date, APR %

Macro

Market sentiment improved this week following the cessation of hostilities between Israel and Iran. Despite significant inflows from traditional finance into crypto ETFs and listed companies, Bitcoin’s price has not yet established a higher high. Historically, Bitcoin has followed different trajectories after all-time highs, either entering a sustained bull market or forming a cycle top. The trajectory will depend on how macroeconomic conditions develop.

On June 18th, the Federal Reserve held its fourth FOMC meeting of the year. Chair Jerome Powell maintained the federal funds rate and did not announce any changes to the current $5 billion monthly quantitative tightening (QT) pace established in March. Powell noted that the Fed is positioned to cut rates if economic conditions weaken but also emphasized uncertainty about future cuts this year. The December SOFR futures market continues to price in a 50-basis point cut by year-end, unchanged since the initial tariff announcements. Powell also stated that trade developments may factor into future policy adjustments.

The European Central Bank (ECB) reduced rates by another 25 basis points on June 6th, marking its second consecutive monthly cut. The Swiss National Bank (SNB) also lowered its rate by 25 basis points to 0%. In contrast, the Bank of England (BOE) and the People’s Bank of China (PBOC) did not cut rates this month. Last month, the ECB, BOE, PBOC, and SNB all implemented cuts, while the Federal Reserve held steady.

The Dollar Index ($DXY), which tracks the value of the US dollar against a basket of other major currencies, fell to 97.32 as of Thursday evening, its lowest level in nearly three years. This weakness began after Israel’s strike on Iran and has continued post-ceasefire.

Meanwhile, 30-year US Treasury yields, which peaked at 5.15% on May 22nd (a level last seen at the end of the 2023 hiking cycle), have declined slightly to 4.81% as of this Thursday. The combination of elevated long-term yields and a weakening dollar suggests ongoing foreign divestment from US assets.

Historically, the Dollar Index and long-term US Treasury yields have exhibited a strong positive correlation. Figure 9 illustrates this relationship between DXY and bond yields.

Figure 9: DXY Index returns (Red), 30-year T-Bond yield returns (Blue), and 10-year T-Bond yield returns (Purple), 3 years

The correlation between a currency and its own government’s bond yields is commonly observed across global markets. In the case of the United States, the Dollar Index ($DXY) and long-term Treasury yields began to diverge after the Liberation Day tariff announcements.

Both equity and bond market implied volatility initially rose following the tariff announcements more than a month ago but have since returned to long-term average levels. The equity volatility index (VIX) is currently at 16.6, down from 20.13 the previous Wednesday, while the Treasury bond volatility index (MOVE) is at 89.47, down from 93.64.

Figure 10: VIX, Daily Candles; 3 Years

Figure 11: Move Index, Daily Candles; 3 Years

Sincerely,

The Hermetica Team