IN THIS ISSUE

💵 USDh ranks in top 10 Runes by volume

🚀 Hermetica 2.0 - feature update

📰 Xverse integrates fiat onramp

💰 USDh yield recap

☎️ Hermetica Hangout: ZeroAuthority DAO

📈 Weekly market review

Like what you see? Follow us on X so you don’t miss any future announcements:

USDh Ranks in Top 10 Runes by Volume

USDh ranked in the top 10 Runes by trading volume this week.

Traders are rotating profits from speculative Runes into USDh for up to 11% APY, while maintaining a stable dollar position directly on Bitcoin.

USDh continues to cement its role as the reliable destination for yield and stability on Bitcoin.

Hermetica 2.0 - Feature Update

Total Yield is now live in your Hermetica Portfolio.

Track exactly how much your USDh has earned over time; day by day, week by week, or total all in one clean view.

Enjoy this as part of Hermetica 2.0, the most transparent and intuitive experience in Bitcoin DeFi.

Xverse Integrates Fiat Onramp

Xverse, the leading Bitcoin wallet, has integrated Onramper to make buying USDh easier than ever.

Users can now purchase directly using credit cards, Apple Pay, Google Pay, and over 170 other local payment methods across 130+ currencies.

With Onramper, Xverse users can onramp from their local currencies straight into STX or BTC, then swap into USDh directly in-app. From fiat to Bitcoin-native yield in minutes.

USDh Yield Recap

Markets this week had the energy of a group project where nobody showed up.

However, USDh clocked in, did the work, and handed in 10% APY. If stablecoins were students, USDh would be the quiet kid running the whole group behind the scenes.

This week, we hosted ZeroAuthority DAO for a conversation on building on-chain reputation in Bitcoin DeFi. If you missed it, catch the recording here.

Next week, we’ll be joined by BOB to discuss how they’re expanding cross-chain Bitcoin’s utility. Set your reminders, these Hangouts keep getting better.

Market Review

Bitcoin price action was muted this week following a sharp decline late last week, coinciding with escalating conflict between Israel and Iran. Annualized realized volatility over the past week sits at 42%, reflecting restrained price movement despite heightened macro uncertainty.

Implied volatility (DVOL) briefly spiked from annual lows last Thursday but has since returned to 40.27%, within 1% of its 12-month low of 39.6%. Given the current geopolitical backdrop, volatility remains low by historical standards.

Futures basis spreads remain compressed, though the front-week contract improved to 3% APR from near 0% last week.

The futures curve is in normal contango, with the average equal-weighted basis spread rising from 4.75% to 5.3% week-over-week, a 0.55% increase. The front end of the curve remains below longer-dated maturities, signaling weak spot demand.

Perpetual futures (perps) funding briefly spiked to 13.14% APR on Monday but remained near zero for the rest of the week.

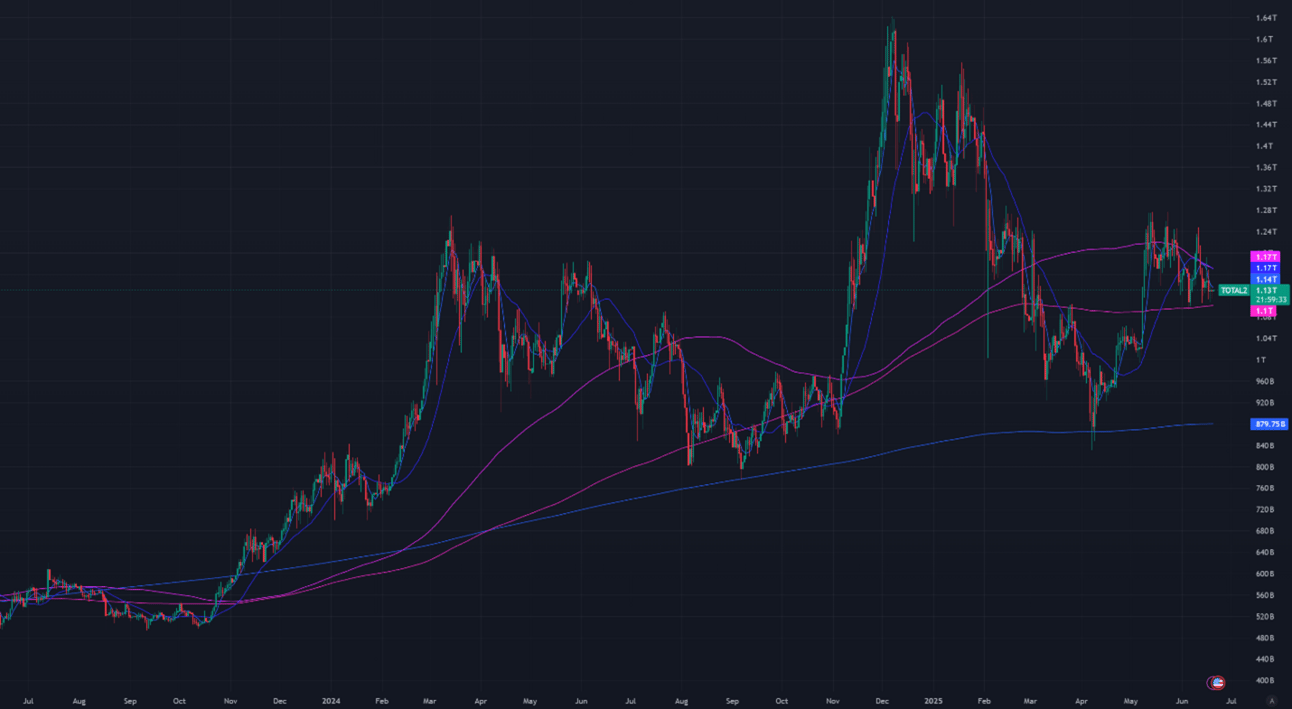

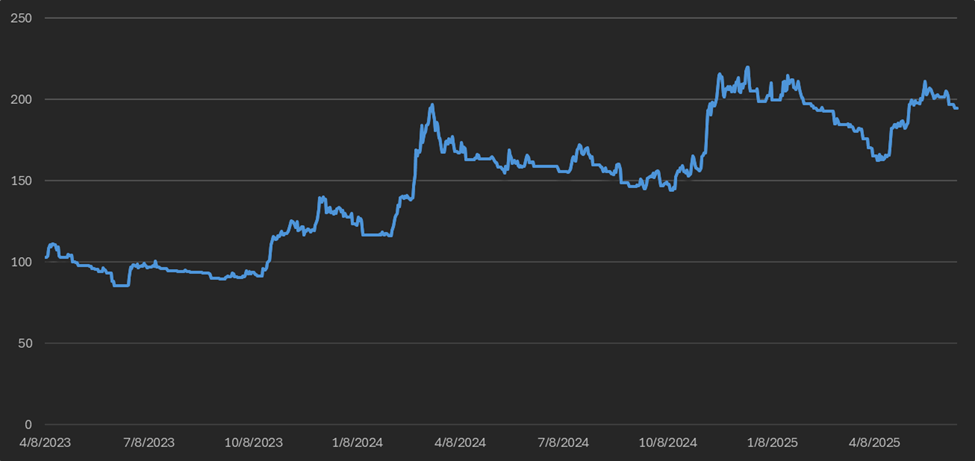

Aggregated altcoin market caps were unchanged at $1.13T for the second consecutive week. Bitcoin dominance rose 0.08% and continues to follow a long-term multi-year uptrend.

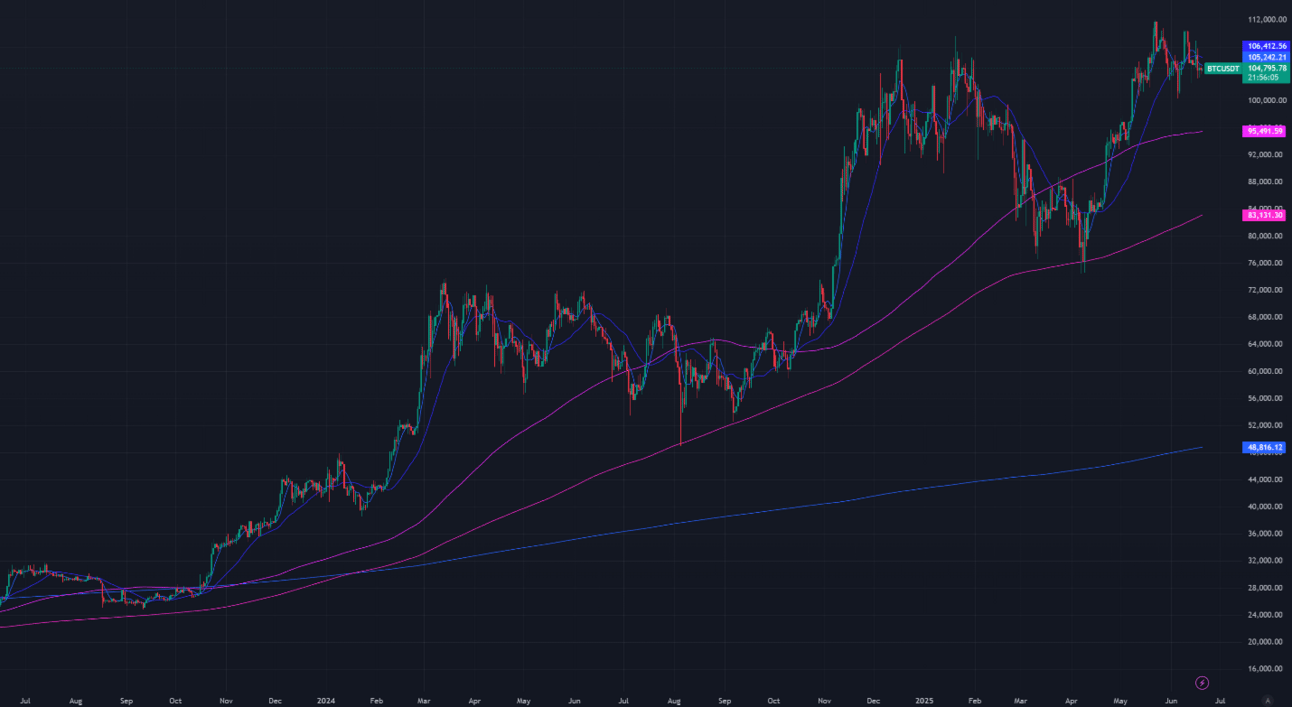

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

7-Day MA: $105,242

30-Day MA: $106,413

180-Day MA: $95,492

360-Day MA: $83,131

200-Week MA: $48,816

Bitcoin’s price remains below all short-term moving averages (MAs) this week. As of last Thursday afternoon, Bitcoin was still in an uptrend. However, it seems the escalating conflicts in the Middle East disrupted the upward trajectory.

Historically, uptrends tend to persist as long as price remains above both short-term MAs. The break below these levels shortly after reaching all-time highs (ATHs) marks a shift in near-term momentum. Current price action appears to be heavily influenced by broader macro liquidity conditions.

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend-following portfolio are now down 9.48% from January’s all-time high. Two months ago, the portfolio was down 22.99%, marking the largest drawdown in long-oriented trend strategies since late 2024, when they declined nearly 25%. The recovery was supported by easing US-China trade tensions, but the recent escalation in the Middle East has introduced new uncertainty.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

BTC ETF Flows

Net outflows this week totaled $1.340 billion. Net inflows rose by $319.2 million compared to the previous week, with positive flows recorded each day. Notably, US markets were closed on Thursday in observance of the Juneteenth federal holiday.

Figure 5: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) currently sits at 40.27%, placing it in the bottom 0.8% of occurrences over the past year. Low implied volatility reflects weak demand for derivatives leverage and reduced hedging activity by market makers. DVOL reached a one-year low of 39.6% last Thursday morning before spiking later that day following military action in the Middle East. DVOL has since retraced to recent lows.

Figure 6: DVOL 1 Year; Bitcoin Index Price; Source: Deribit

Basis Spread

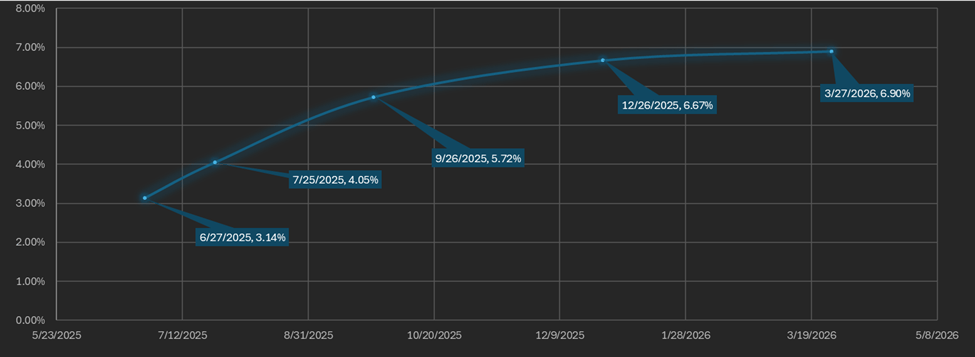

The basis spread, or the price of a futures contract over its spot price, remains positive across all maturities. The average (equal-weighted) basis spread rose 0.55% this week, from 4.75% APR to 5.3% APR. However, it is still down 3.85% APR from its peak of 9.15% exactly one month ago, a 42% decline from that high.

The futures curve is in normal contango, with the front-week contract (June 27th) yielding 3.14%, the lowest on the curve, and maturities rising steadily through the March 2026 contract at 6.9%. The spread between the lowest and highest yielding maturities narrowed to 3.77%, down from 5.43% last week.

Figure 7: Futures Curve; Maturity Date, APR %

Market makers typically hedge their spot‐exposure by trading the front‐month futures, while speculative players tend to focus on the longer end of the curve. A drop in front‐end prices often reflects both a weakening spot market and reduced demand for short‐duration options.

The ideal futures curve is a downward sloping contango where demand for closer maturities outstrips the supply market makers can obtain in the short run. The futures curve from January (Figure 8) exemplifies a market under high spot demand.

Figure 8: Futures Curve Bullish Example; Maturity Date, APR %

Macro

Market euphoria returned last month after the United States and China agreed on tariff actions, but geopolitical events in the Middle East are now weighing on upward price momentum. Even the passage of the “Stablecoin Act” through the U.S. Senate this week had little observable impact on cryptocurrency prices.

Historically, following an all-time high (ATH) breakout, Bitcoin has either entered a sustained bull market, such as in 2017 and early 2021, or marked a cycle top, as in late 2021. Which pattern plays out this time will depend heavily on the broader macroeconomic environment.

On June 18th, the Federal Reserve held its fourth FOMC meeting of the year. Powell did not cut rates nor announce any reduction in quantitative tightening (QT) from the $5 billion level set at the March meeting. The meeting was largely uneventful, with Powell reiterating that the current rate level provides flexibility if the economy slows. He noted ongoing uncertainty about whether any rate cuts will occur this year. The December SOFR futures market continues to price in a 50 basis point (bp) cut by year-end, unchanged since the tariff announcements earlier this year.

The European Central Bank (ECB) cut rates by another 25 bps on June 6th, marking the second consecutive month of rate reductions. As cited by the ECB, tariffs affect economies differently. The U.S., as a major importer, experiences inflationary pressure on domestic goods, while exporting nations like those in the EU may experience deflationary pressure on their own goods. This gives the ECB comparatively more room to lower rates.

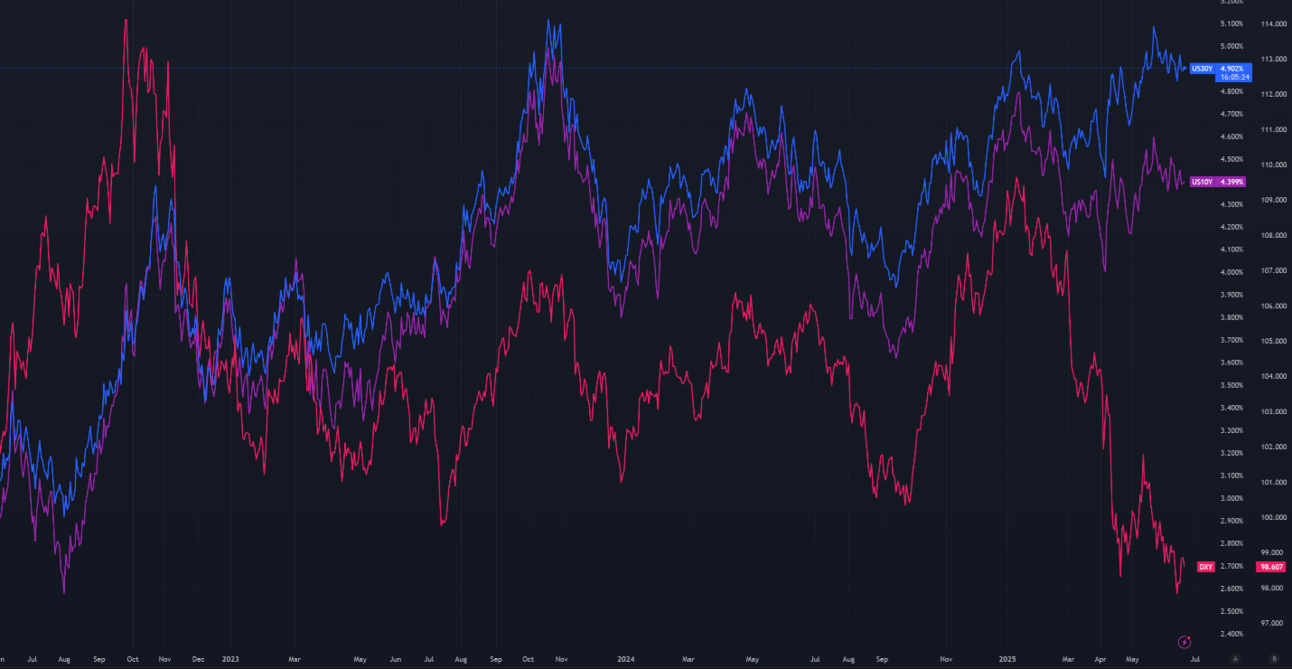

The Dollar Index ($DXY), which measures the value of the U.S. dollar relative to a basket of other currencies, fell to 98.6 as of Thursday evening, near a three-year low. DXY declined following the conflict in the Middle East, reflecting potential market concerns over potential U.S. involvement in the conflict and the fiscal implications that may follow. Meanwhile, 30-year Treasury yields peaked at 5.15% on May 22nd, the highest since the end of the 2023 rate-hiking cycle, before falling to 4.9% this Thursday. Elevated long-term yields alongside a weakening dollar suggest foreign investors may be reducing exposure to U.S. assets. Historically, $DXY and Treasury yields have maintained a strong positive correlation.

Figure 9: DXY Index returns (Red), 30-year T-Bond yield returns (Blue), and 10-year T-Bond yield returns (Purple), 3 years

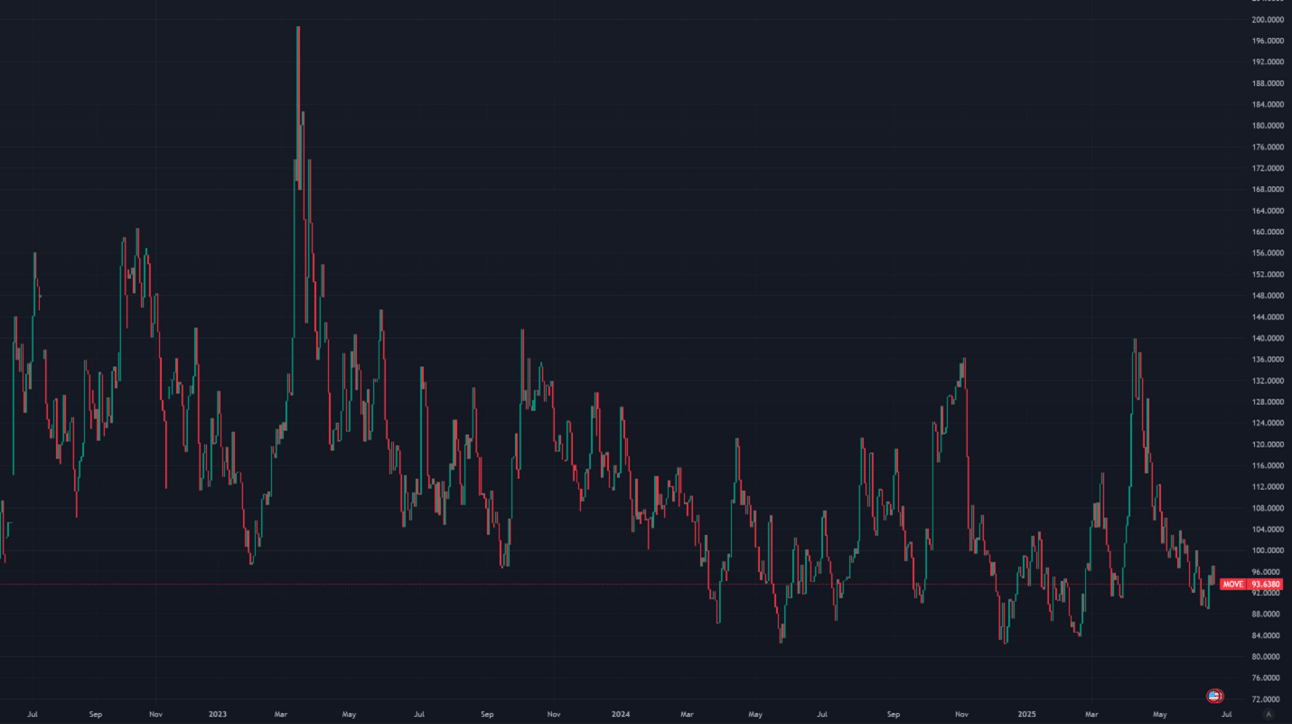

The correlation between a currency and its own government’s bond yields is observed in most currencies. $DXY and long-term yields began to decouple after the tariff announcements earlier this year and have remained decoupled amid concerns over the fiscal outlook of the U.S. government. Both equity market implied volatility (VIX) and U.S. Treasury bond implied volatility (MOVE) surged following the tariff announcement, but have since returned to long-term averages.

The VIX is currently 20.13, up from 18.01 the previous Thursday, while the MOVE index is 93.64, up from 88.99. Last week’s equity and bond markets closed before the conflict in Iran, so the initial geopolitical risk was not yet priced into those volatility indexes.

Figure 10: VIX, Daily Candles; 3 Years

Figure 11: Move Index, Daily Candles; 3 Years

Sincerely,

The Hermetica Team