IN THIS ISSUE

📰 Copper integrates sBTC

🔵 Coinbase’s Q2 report

💰 USDh yield recap

☎️ Hermetica Hangout: Deorganized media

📈 Weekly market review

Like what you see? Follow us on X so you don’t miss any future announcements:

Copper Integrates sBTC

Copper, one of the leading institution-grade digital asset custodians, has added support for sBTC stacking.

Institutional clients can now enjoy secure access to yield opportunities within Bitcoin DeFi, without leaving their trusted custody platform.

This integration is another step forward as Stacks continues expanding access to Bitcoin DeFi for individuals and institutions.

Coinbase’s Q2 Report

Coinbase’s Q2 2025 report confirms that stablecoins are powering financial adoption.

In 2024, $27.6 trillion in stablecoin transfers outpaced Visa and Mastercard combined. Use cases like remittances, payroll, and payments are going mainstream, with over 80% of crypto-aware businesses looking to move money faster.

As regulation evolves, Bitcoin-backed yield-bearing stablecoins like USDh are primed to lead the next chapter, offering both utility and passive income.

USDh Yield Recap

USDh posted 7% APY this week.

Your bank, not to be outdone, hit you with a push notification about dark mode. Reminder, our dark mode earns yield while your bank just changes the background.

Hermetica Hangout: Deorganized Media

This week, we hosted Deorganized Media for an insightful discussion on amplifying BTCfi narratives with user education and onboarding through media platforms like theirs.

Next week, we’re hosting Zero Authority DAO, an on-chain reputation-based platform redefining trust in Bitcoin applications. Set your reminder, you won’t want to miss it.

Market Review

Bitcoin is reacting to a global liquidity crunch following Israel’s strike against Iran Thursday night. Most global assets experienced sharp drawdowns, except for those typically viewed as geopolitical hedges, including crude oil, gold, and the Japanese Yen. Bitcoin outperformed the broader crypto market, and this trend has continued relative to altcoins.

Implied volatility (DVOL) bounced from 1-year lows of 39.6 following the onset of the strikes, but remains relatively subdued at 42.48 as of this writing. Despite the volatility spike, DVOL remains low by historical standards.

Futures basis spreads declined across the board, with front-week futures yields approaching zero. The futures curve remains in a normal contango, with the average equal-weighted basis spread falling 0.91% week-over-week.

Perpetual futures (perps) funding briefly turned negative following the initial news but has since returned to zero.

Aggregated altcoin market caps were flat week-over-week at $1.13T. Bitcoin dominance rose 0.12% this week, breaking out of its recent short-term downtrend following the May 7th peak. The broader multi-year uptrend in Bitcoin dominance remains intact.

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

7-Day MA: $107,182

30-Day MA: $104,134

180-Day MA: $95,278

360-Day MA: $82,312

200-Week MA: $48,521

Bitcoin’s price is below all short-term moving averages (MAs) this week. As of Thursday afternoon, Bitcoin was in an uptrend. However, the strikes on Thursday evening interrupted the trajectory. Historically, uptrends tend to remain intact as long as price stays above both short-term MAs. The break below these levels shortly after reaching all-time highs (ATHs) suggests a shift in momentum.

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend-following portfolio are now down 8.34% from January’s all-time high. A month ago, the portfolio was down 22.99%, marking the largest drawdown in long-oriented trend-following strategies since late 2024, when they declined nearly 25%.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

Liquidations

Bitcoin long liquidations across all exchanges totaled $517.28 million. The majority occurred Thursday evening and Friday morning, following price declines triggered by geopolitical developments in the Middle East.

Figure 5: Bitcoin Long and Short Liquidations, Bitcoin Price; Source: Coinglass

BTC ETF Flows

Net outflows this week totaled $1.021 billion. This marks a $1.72 billion shift from last week, with flows turning positive again. Since US markets were closed during the Israeli strike on Iran, the impact of Thursday night's price drop is not yet reflected in this week’s flow data.

Figure 6: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) currently sits at 42.48%, placing it in the bottom 1.6% of occurrences over the past year. DVOL reached a one-year low of 39.6% on Thursday morning before spiking in response to the strikes that evening.

Low implied volatility typically reflects subdued demand for derivatives leverage and reduced hedging activity from market makers. While DVOL briefly rose in mid-May as options exposure increased, short positions have since moved out of the money, contributing to the return of low volatility levels. Should downside price pressure resume alongside further geopolitical developments, DVOL may rise again.

Figure 7: DVOL 1 Year; Bitcoin Index Price; Source: Deribit

Basis Spread

The basis spread, or the price of a futures contract over its spot price, remains positive across all maturities. The average (equal-weighted) basis spread declined 0.91% this week, from 5.56% APR to 4.75% APR, and has fallen 4.4% from its peak three weeks ago, when it reached 9.15%. This represents a 48% decline in basis yield over that period.

The futures curve remains in normal contango, with the front-week contract (June 20th) yielding the lowest APR at 1.3%, and maturities rising steadily through to the March 2026 contract at 6.73%.

The spread between the lowest and highest yielding maturities widened to 5.43%, up from 1.96% last week.

Figure 8: Futures Curve Bullish Example; Maturity Date, APR %

The ideal futures curve in a bullish environment is a downward-sloping contango, where demand for near-term maturities exceeds the available supply that market makers can source in the short run. The futures curve from January (Figure 9) illustrates such a structure, reflecting strong spot demand.

Market makers use front-month futures to hedge short-duration exposures such as front-week/month options, perps, and spot. Concentrating hedging activity in shorter maturities allows them to manage larger books while maintaining delta neutrality. When front-end APRs exceed those of longer-dated contracts, it typically indicates stronger short-term bullish sentiment.

Figure 9: Futures Curve Bullish Example; Maturity Date, APR %

Macro

Market euphoria returned last month after the United States and China agreed to suspend their tariff dispute, but recent geopolitical developments in the Middle East have disrupted upward price momentum. Historically, Bitcoin’s breakouts to new all-time highs have preceded either extended bull markets (as in 2017 and early 2021) or marked the end of a cycle (as in late 2021). Current trajectory will likely depend on the broader macroeconomic and geopolitical backdrop.

On Thursday evening, Israel conducted airstrikes against Iranian targets. Iranian energy infrastructure is a central component of the country’s economy, and any disruption to its production or export capacity could have a significant impact on global markets. Brent and WTI crude oil prices have already risen by more than 10% this week in anticipation of further escalation.

On May 7th, the Federal Reserve held its third FOMC meeting of the year. The Fed left interest rates unchanged and made no adjustments to its $5 billion monthly pace of quantitative tightening (QT). Chair Powell reiterated that the current stance provides flexibility to ease if economic conditions warrant. Market-based expectations for rate cuts remain stable, with the December SOFR futures continuing to price in a 50-basis point cut by year-end. The next FOMC meeting is scheduled for Wednesday. As of now, futures markets assign a 97% probability to no rate change.

The European Central Bank (ECB) cut rates by another 25 basis points last Thursday, its second consecutive cut. Last month, the ECB, Bank of England (BOE), People’s Bank of China (PBOC), and Swiss National Bank (SNB) all eased policy. In contrast, the Fed has held steady. The Bank of Japan (BOJ) continues to diverge from its peers, raising short-term interest rates after a prolonged delay. Japanese long-term yields and the Yen have been rising, driven by a shift in capital away from the US dollar into safer domestic assets. This appreciation has contributed to the unwind of USD/JPY carry trades and added pressure to US bond markets.

The Dollar Index ($DXY), which tracks the US dollar against a basket of major currencies, fell to 98.21 as of Thursday evening, its lowest level in nearly three years. The move followed news of Israel’s attack on Iran and reflects market concerns over possible US involvement in the conflict and its potential fiscal consequences.

Historically, the Dollar Index and long-term Treasury yields have shown a strong positive correlation. Figure 9 illustrates this relationship over recent years.

Figure 10: DXY Index returns (Red), 30-year T-Bond yield returns (Blue), and 10-year T-Bond yield returns (Purple), 3 years

The correlation between a currency and its own government’s bond yields is observed across most major economies. This relationship exists because higher domestic yields create a positive carry trade opportunity against lower-yielding foreign bond markets. For example, if both Japan and the US have 1% interest rates, and the US raises its rate by 0.5%, traders can borrow Yen, convert it to Dollars, and purchase US Treasury bonds at a yield premium, earning a return on the interest rate differential while assuming currency risk. This carry trade can enhance returns but exposes traders to losses if the Yen strengthens relative to the Dollar.

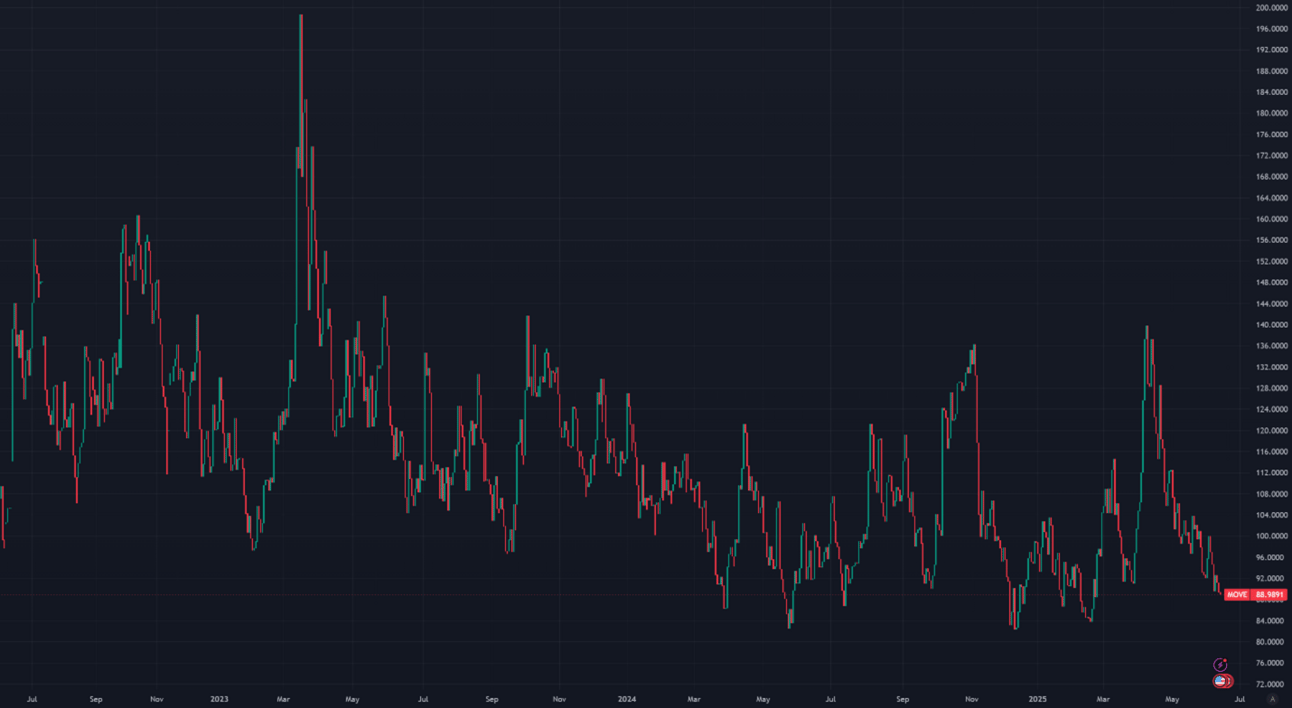

Both equity market implied volatility (VIX) and US Treasury bond implied volatility (MOVE) spiked following the tariff announcement over a month ago but have since returned to long-term averages. As of this writing, the VIX is at 18.01, up from 17.13 last Thursday, while the MOVE index has declined from 94.65 to 88.99. Equity and bond markets were closed during Israel’s strike on Iran, and their respective volatility indices have not yet priced in the latest geopolitical developments.

Figure 11: VIX, Daily Candles; 3 Years

Figure 12: Move Index, Daily Candles; 3 Years

Sincerely,

The Hermetica Team