IN THIS ISSUE

💵 Buy USDh with USDC on Ethereum

🔶 Wormhole integrates Stacks

💰 USDh yield recap

☎️ Hermetica Hangout

📈 Weekly market review

Like what you see? Follow us on X so you don’t miss any future announcements:

Buy USDh with USDC on Ethereum

Cross-chain swaps are now live on Hermetica.

Allbridge infrastructure is now directly integrated in our app, enabling you to bridge USDC from Ethereum to Stacks and seamlessly swap it into USDh.

It’s now easier for individuals and institutions on Ethereum to rotate into a Bitcoin-backed, yield-bearing stablecoin. The swap path is fully non-KYC and open to anyone with a MetaMask wallet.

Wormhole Integrates Stacks

Wormhole is integrating Stacks to enable seamless, secure cross-chain transfers for Stacks-native assets like sBTC and STX through its Native Token Transfers (NTT) framework.

Wormhole’s infrastructure connects capital, liquidity, and Stacks-native applications including Hermetica to other chains.

USDh Yield Recap

This week USDh printed 11% APY. If your team showed up every day with this kind of consistency, positive attitude, and steady returns, you'd nominate them for a raise.

USDh doesn’t take lunch breaks, doesn’t call in sick, and never asks for equity. It just shows up, does its job, and earns.

Hermetica Hangout

This week, we gave our app the microphone with the launch of our USDC to USDh cross-chain swaps.

Next week, we shift the spotlight to builders with FarmerJoe, a Runes OG and one of the most plugged-in voices in the BTCFi space. Set your reminder, you don’t want to miss this one.

Market Review

Bitcoin rallied this week but encountered resistance at the $110,000 level. This price level has acted as a barrier twice before, once in May and again in June.

DVOL collapsed to 37.93 and has remained within that range since.

Futures basis spreads remain subdued despite a rise in front-end contracts. The futures curve is in a normal contango, with the average equal-weighted basis spread declining slightly week-over-week to 5.02%.

Perpetual futures (perps) funding rates were positive for most of the week, peaking at 19.71% APR on Friday morning.

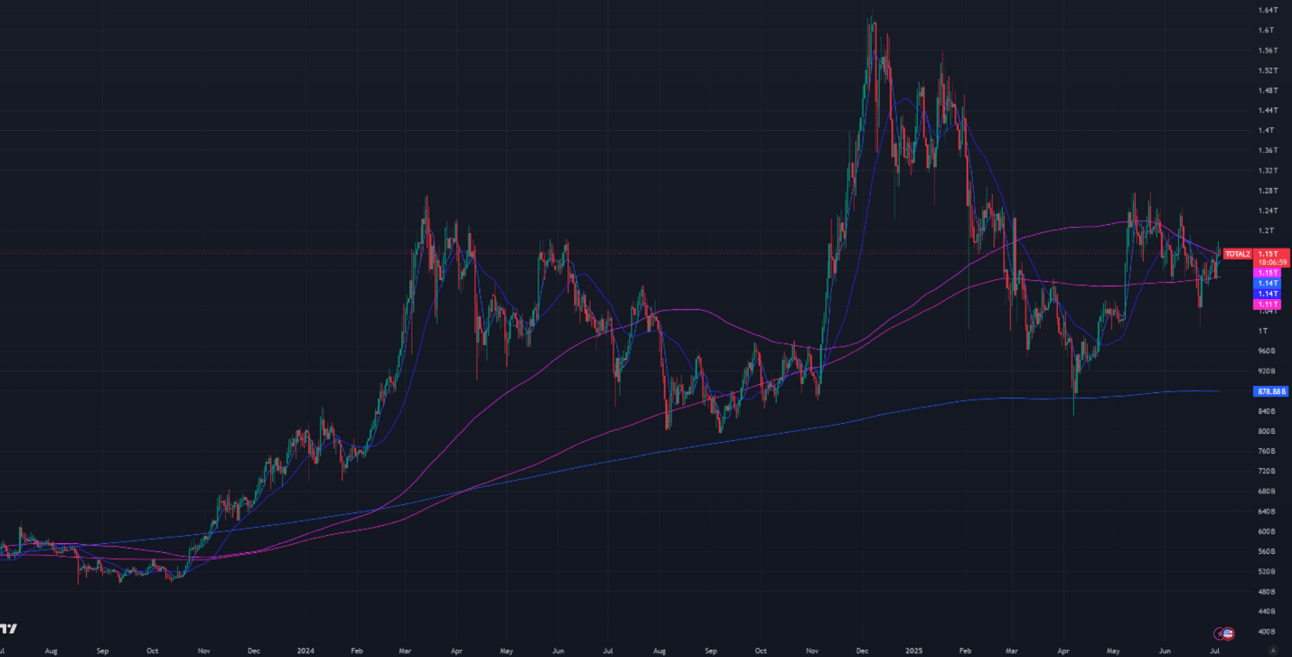

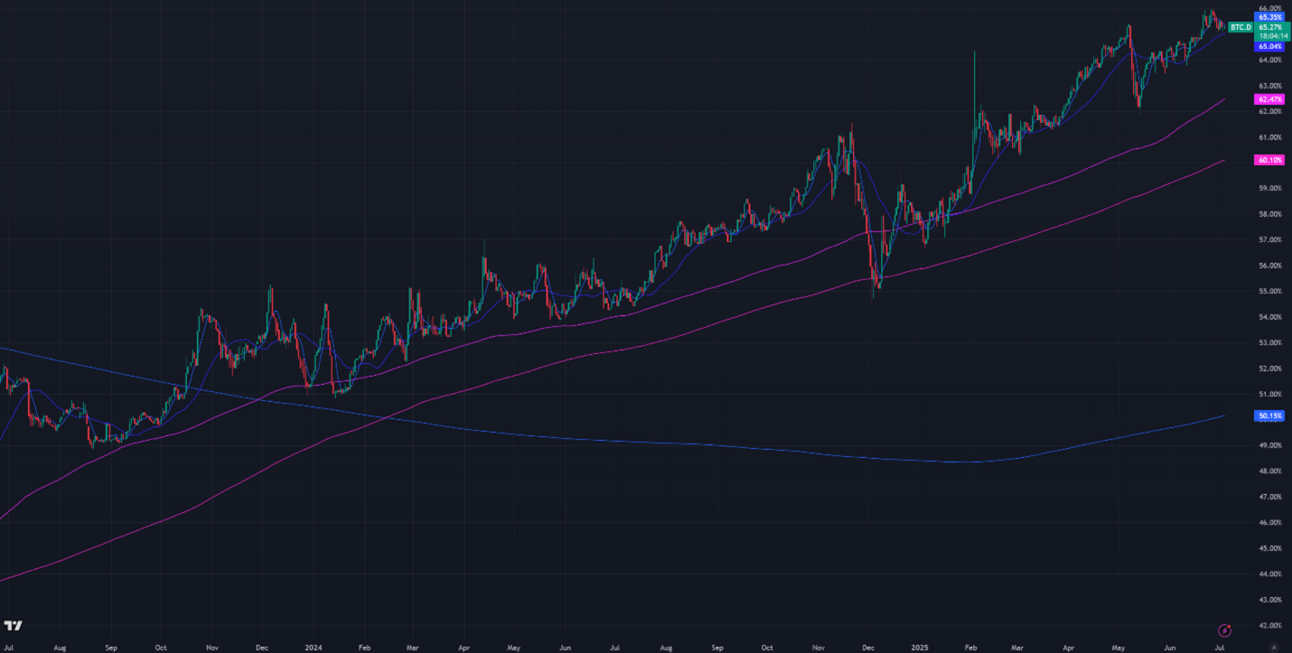

Aggregated altcoin market caps rose modestly from $1.11T to $1.15T. Bitcoin dominance declined by 0.56%, but remains near multi-year highs.

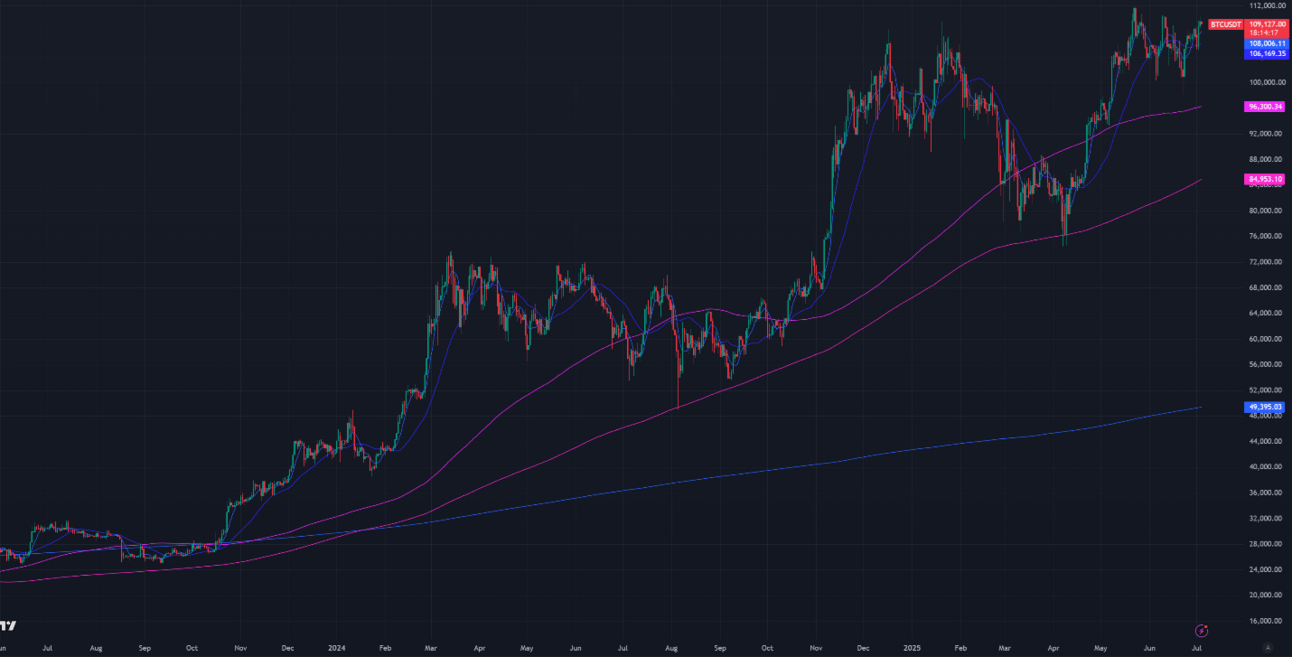

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $109,130

7-Day MA: $108,010

30-Day MA: $106,170

180-Day MA: $96,300

360-Day MA: $84,950

200-Week MA: $49,400

Bitcoin is now above all short-term moving averages (MAs).

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend-following portfolio are now down 8.42% from January’s ATH. Two months ago, the drawdown reached 22.99%, the largest since late 2024, when portfolios fell nearly 25%. The recent price recovery was too sharp for the long trend algorithm to capture early, resulting in only a 1% portfolio recovery despite Bitcoin approaching ATHs.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

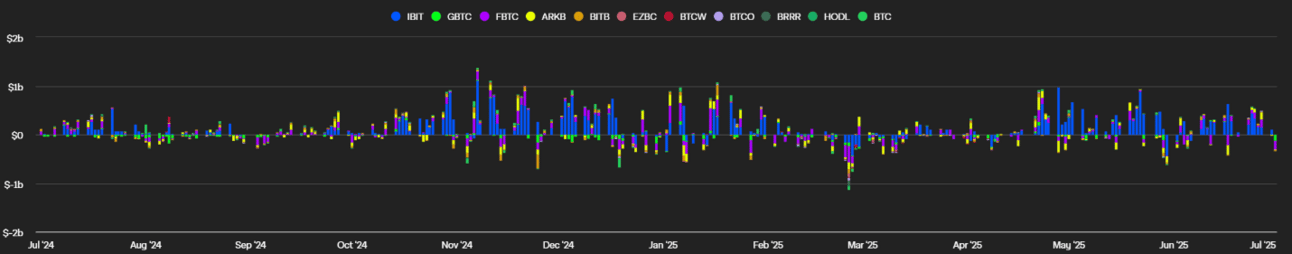

BTC ETF Flows

Net outflows this week totaled $1.27 billion. Despite recent tensions, Bitcoin ETFs have seen over $1 billion in weekly inflows throughout the past month.

Figure 5: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) currently sits at 38.49%. DVOL reached a low of 36% this week, the lowest level since October 2023. Persistently low implied volatility can reflect weak demand for derivatives leverage.

Figure 6: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

Basis Spread

The basis spread, or the price of a futures contract over its spot price, remains positive across all maturities. The average (equal-weighted) basis spread declined this week by 0.27% APR, from 5.29% to 5.02%. However, it is still down 4.13% APR, or 45%, over the past six weeks.

The futures curve is in a normal contango, with the front week contract (July 11th) showing the lowest APR at 4.07%, and maturities rising almost continuously through the newly issued Q2 June 2026 contract at 6.47%. The spread between the lowest and highest yielding maturity is now 2.11%, up from 1.64% last week, likely due to the launch of the new Q2 2026 contract.

Figure 7: Futures Curve; Maturity Date, APR %

Market makers frequently use front-month futures contracts to hedge spot exposure, while speculative traders tend to engage with the long end of the curve. The recent decline in front-end yields may reflect reduced demand for spot and short-duration options.

The ideal futures curve is a downward sloping contango where demand for closer maturities outstrips the supply market makers can obtain in the short run. The futures curve from January (Figure 8) exemplifies a market under high spot demand.

Market makers rely on front-month futures to hedge short-dated exposures such as front-week/month options, perpetuals, and spot holdings. Hedging with shorter maturities allows market makers to manage larger books while maintaining delta neutrality. When yields on front maturities are higher than those on longer maturities, it typically signals strong short-term bullish sentiment.

Figure 8: Futures Curve Bullish Example; Maturity Date, APR %

Macro

Market optimism returned this week as tensions in the Middle East cool. However, Bitcoin continues to struggle with ATHs despite significant inflows from traditional finance (TradFi) into crypto ETFs and companies. Historically, Bitcoin has either entered a sustained bull market after breaking all-time highs, such as in 2017 and early 2021, or topped out, as in late 2021. The direction that follows will depend heavily on broader macroeconomic conditions.

On June 18th, the Federal Reserve held its fourth FOMC meeting of the year. There were no changes to interest rates or the pace of quantitative tightening (QT), which remains at the $5 billion monthly reduction level set in March. In contrast, the European Central Bank (ECB) reduced rates by another 25 basis points on June 6th, marking the second consecutive monthly cut. The Swiss National Bank also lowered rates by 25 basis points to 0%. However, the Bank of England (BOE) and the People’s Bank of China (PBOC) held rates steady.

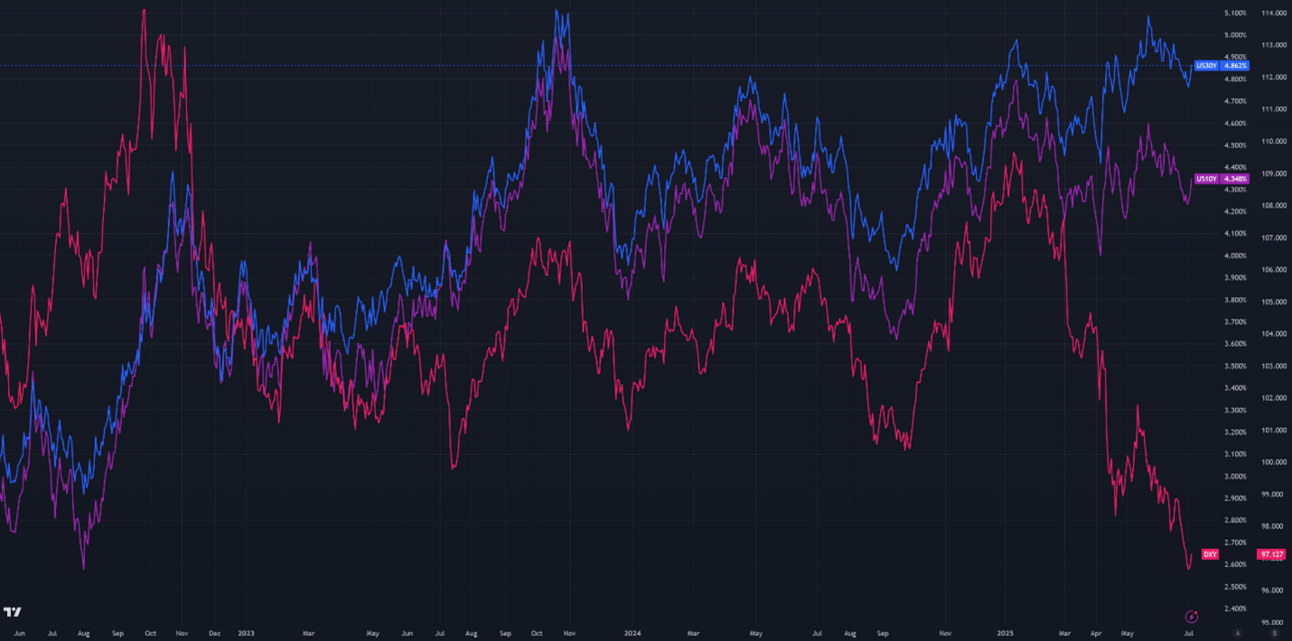

The U.S. Dollar Index (DXY), which measures the dollar’s value against a basket of foreign currencies, fell to 96.94 as of Friday morning, its lowest level in nearly three years.

Meanwhile, 30-year U.S. Treasury yields, which peaked at 5.15% on May 22nd, have since pulled back to 4.86% as of this Thursday. Despite the decline, yields remain near multi-year highs.

Historically, there has been a strong positive correlation between DXY and long-term U.S. Treasury yields. Figure 9 illustrates this relationship between the relative value of the dollar and U.S. sovereign bond yields.

Figure 9: DXY Index returns (Red), 30-year T-Bond yield returns (Blue), and 10-year T-Bond yield returns (Purple), 3 years

There is a well-established correlation between a currency and its own government’s bond yields. For the U.S., the Dollar Index ($DXY) and long-term Treasury yields began to diverge investors focus on long-term fiscal dynamics.

Implied volatility across asset classes initially surged after the tariff announcements. Both the equity volatility index (VIX) and Treasury bond volatility index (MOVE) spiked but have since returned to long-term averages. As of this writing, the VIX is at 16.37, roughly unchanged from 16.6 the prior Wednesday, while the MOVE index has fallen to 86.09 from 89.47.

Figure 10: VIX, Daily Candles; 3 Years

Figure 11: Move Index, Daily Candles; 2 Years

Sincerely,

The Hermetica Team