IN THIS ISSUE

📰 USDh: Stacks’ largest stable

🍊 sBTC yield trade

💰 USDh yield recap

☎️ Hermetica Hangout: Community call

📈 Weekly market review

Like what you see? Join our exclusive, ever-growing community on Discord and take part in future product launches:

USDh: Stacks’ Largest Stable

USDh is now the largest stablecoin on Stacks with a fresh liquidity infusion of $3 million.

We're excited to collaborate with DeFi protocols like Zest to offer users new, high-yield opportunities for borrowing, staking, and earning.

Bonus: With increased liquidity, USDh staking yields are 40-60% APY for a limited time.

This extra high yield is due to an excess of USDh liquidity versus how much is staked, so it won't last. Take advantage by staking your USDh now:

sBTC Yield Trade

sBTC is now a collateral asset on Zest! You can now use sBTC to combine Zest’s lending market with USDh’s staking yield.

It’s simple:

🔸 Supply sBTC as collateral on Zest

🔸 Borrow USDh from Zest

🔸 Stake USDh on Hermetica’s app to earn up to 25% APY (or up to 60% APY if you move fast enough)

Learn more in our guide and borrow USDh on Zest to get started.

USDh Yield Recap

It wasn’t hyperbole when we said you can expect temporarily increased yields with the new liquidity.

This week, USDh stakers earned 57% APY. Turning up the heat on yields like never before.

It’s never too late to get on the train.

Hermetica Hangout: Community Call

This week, we had the pleasure of hosting our community call with the founders building Bitcoin DeFi.

We talked about all things liquidity and USDh with Jakob, our Founder and CEO, along with friends from Zest (Tycho), Bitflow (Diego & Dylan), Velar (Georges), and ROO (Jackbinswitch). Catch up on the recording if you couldn’t attend live.

Tune in next week for another Hermetica Hangout. Make sure you follow the account and have notifications turned on so you don’t miss a thing.

Market Review

Bitcoin briefly reached a new all-time high (ATH) of $109,500 this week before settling between $102,000 and $107,000.

Altcoins underperformed Bitcoin over the past month but saw a boost after a New York Post article speculated that the U.S. government’s “Bitcoin Strategic Reserve” (BSR) might include U.S.-based altcoins. This was confirmed Thursday when President Donald Trump signed an executive order to establish a “Digital Asset Stockpile” (DAS) and recommended holding seized crypto assets in the DAS. The news triggered a rally in Bitcoin and altcoins, though most, except Solana, remain far from recent highs.

The crypto market cap (excluding Bitcoin) hit a higher high last weekend before the inauguration, while Bitcoin reached its ATH on inauguration day. Altcoins are still down 10.20%, compared to Bitcoin's 3.62% drawdown.

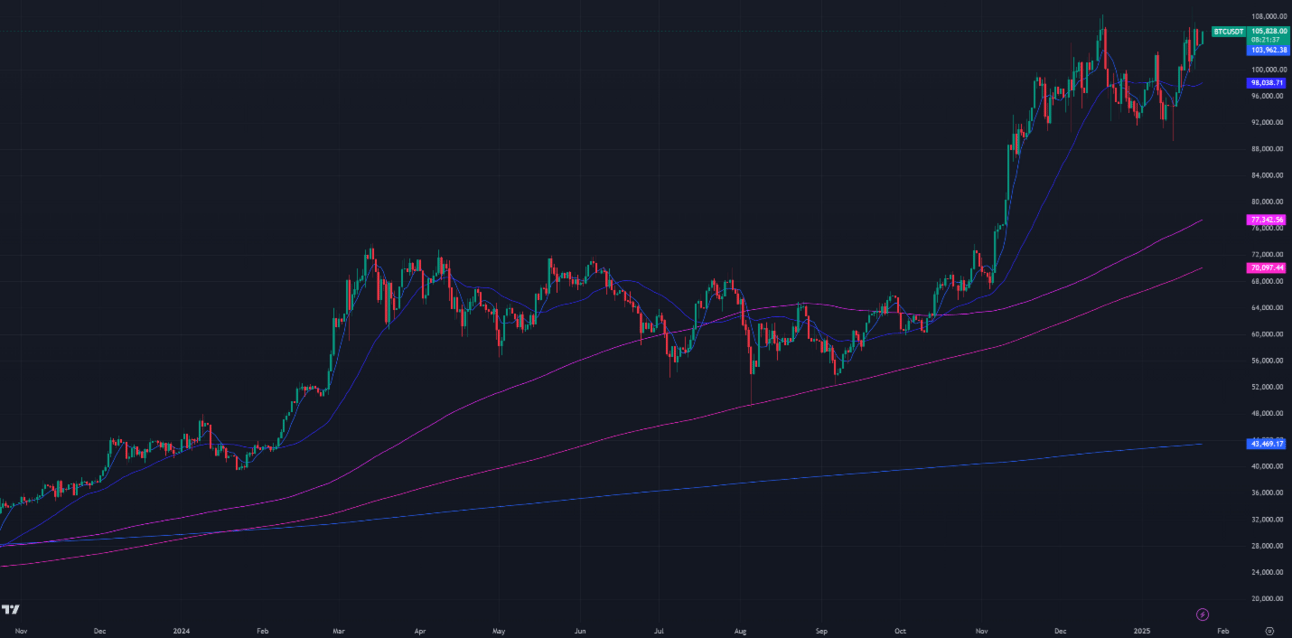

[Figure 1: BTC Price, Daily Candles & Moving Averages; 1 year; Source: Binance]

[Figure 2: Crypto Market Cap Excluding Bitcoin & Moving Averages, Daily Candles; 1 year]

The moving averages (MA) in Figure 1 are:

7-Day MA: $103,962

30-Day MA: $98,039

180-Day MA: $77,343

360-Day MA: $70,097

200-Week MA: $43,469

The 7-day and 30-day moving averages (MAs) often act as key support during bull markets. Last month, the price broke below these MAs three times, challenging the multi-month uptrend. However, prices have recovered above all MAs in the past three days, nearing price discovery once again. Bullish momentum was further reinforced by the 7-day MA crossing above the 30-day MA for the first time since the downtrend began a month ago.

Key downside levels for Bitcoin to watch include $104,000, $99,000, $98,000, $94,000, $92,000, $90,000, $89,000, $88,000, $74,000, $72,000, $70,000, or $68,000. On the upside, levels are $106,000, $108,000, 109,500.

The Bitcoin returns are as follows:

1 month: 0.7%

3 months: 49.3%

6 months: 46.6%

12 months: 150.5%

Bitcoin's trailing annual return is currently 150.5%, nearly three times its average annual return of 56% since 2015. This elevated return is expected to persist through February 2025, assuming no further rally. Historically, periods of above-average returns are often followed by below-average ones.

After a gradual downtrend following the BTC ETF launch in Q1 2024, Bitcoin rebounded sharply after Donald Trump's reelection on November 5, 2024. While high trailing returns alone don’t signal a market top, they can, when combined with other metrics, indicate potential long-term tops or bottoms.

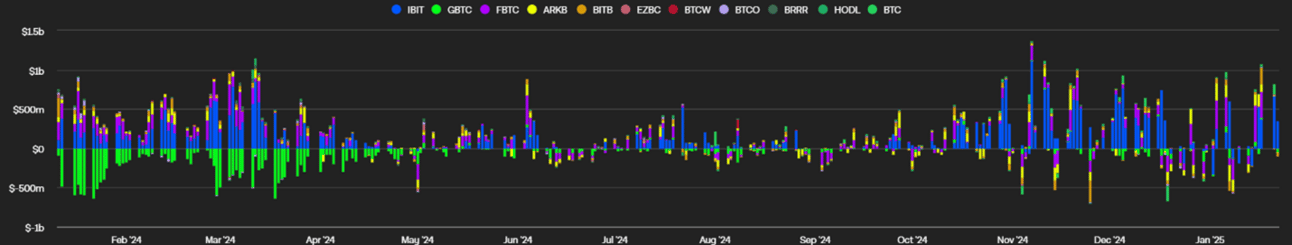

BTC ETF Flows

Net BTC ETF inflows since last Friday totaled $2.313 billion, reaching levels not seen since the week of November 22. Despite being shortened by Monday's holiday and the inauguration, this week saw a surge in inflows to new highs.

[Figure 3: Bitcoin ETF Flows; Daily Bars; Source: The Block]

Volatility

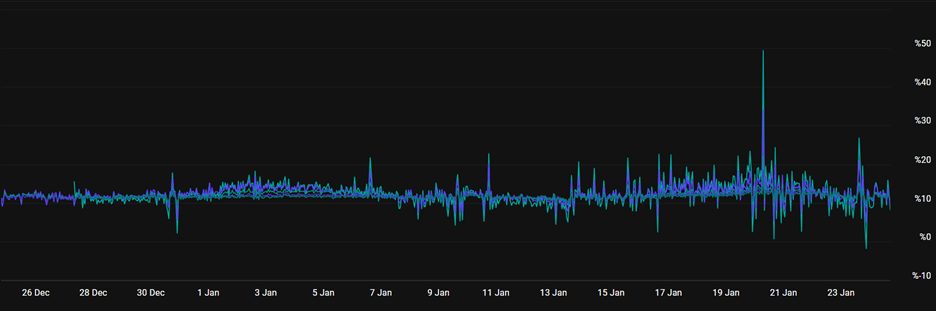

Bitcoin's implied volatility (DVOL) is currently at 58.84%, in the 64th percentile of its average over the past year. For the last two months, DVOL has ranged between 55% and 65%, briefly spiking when Bitcoin hit a new ATH on Inauguration Day before quickly dropping.

The weekend before the inauguration saw the launch of $TRUMP and $MELANIA coins, which strained liquidity across crypto markets. This triggered a selloff in most coins, except $SOL and $TRUMP. During the meme coin launches, options liquidity on Deribit dried up as market makers avoided quoting in such volatile conditions.

[Figure 4: DVOL 1 Year; Bitcoin Index Price; Source: Deribit]

Basis Spread

The basis spread, representing the premium of futures prices over spot prices, remains positive across all maturities. This week, the average basis spread declined from 14.17% to 11.23%, remaining relatively flat since the start of the month.

[Figure 5: Futures APR % over spot price 1 month; Source: Deribit]

The futures curve is in normal contango starting from the front-week contract (January 31). It remains relatively flat, with both the back-week (February 7) and back-month (February 28) contracts priced below the front week. The spread between the lowest and highest yielding maturities has narrowed significantly to 0.81%, down from 8.93% last week.

[Figure 6: Futures Curve; Maturity Date, APR %]

The current futures curve is neutral compared to recent weeks. In contrast, last week’s curve (Figure 7) showed a steep downward-sloping contango, signaling high demand for closer maturities, detached from Bitcoin’s long-run APR. This steepness arises as market makers hedge short perpetual and spot positions using front-month futures (especially on Deribit) during periods of heightened demand.

A steeper curve reflects increased leverage demand and strong market anticipation of near-term price action, indicating a more bullish outlook compared to previous weeks.

[Figure 7: Futures Curve Bullish Example; Maturity Date, APR %]

Macro

On December 18, 2024, the Federal Reserve delivered hawkish rate guidance during the FOMC meeting. The news triggered a sharp rise in volatility. Equity implied volatility (VIX) spiked to 28.43 from 13.44 but has since returned to 14.7, while Treasury volatility (MOVE) increased modestly from 82.66 to 88.51. Meanwhile, 30-year Treasury yields surged 16% from December 6, reaching 4.97% before retreating slightly to 4.83%, near levels last seen during October 2023’s peak rate hikes.

High long-term rates suggest markets expect the Fed to pause rate cuts for an extended period to curb inflation, partly driven by rising crude oil prices after new sanctions on Russia. U.S. companies, heavily reliant on debt, face refinancing challenges with Treasury rates above 4%.

The Fed’s next FOMC meeting on Wednesday will be pivotal, with rates expected to hold steady at 4.25–4.5%. However, guidance on rate cuts for 2025 could drive market moves. A continued hawkish stance would likely pressure Bitcoin’s price downward.

[Figure 8: VIX, Daily Candles; 2 Year]

[Figure 9: Move Index, Daily Candles; 2 Years]

Sincerely,

The Hermetica Team