- Hermetica

- Posts

- Weekly Update - January 2, 2025

Weekly Update - January 2, 2025

A Year of Consistent Execution

IN THIS ISSUE

📆 A Year of Consistent Execution

🗞️ Q3 State of Stacks

💰 USDh Yield Recap

📈 Weekly Market Review

Jakob TL;DR

What’s your 2025 story?

For us, 2025 was about consistency. We executed reliably across product performance, risk controls, and transparency. USDh TVL increased over 400% since the start of 2025, and more importantly, the underlying strategy worked without fail. What’s next for us: Institutional-grade Bitcoin yield, in a variety of products.

That momentum extended beyond us. Stacks closed Q3 with increased network activity, as shown in Messari’s State of Stacks report.

Stay tuned. I’ll have more to say about the 2026 plans soon.

A Year of Consistent Execution

Winter is here. Naturally, we’ve been getting the same question: Where is hBTC?2025 was defined by consistency. We executed reliably across product performance, risk controls, and transparency.

USDh, our Bitcoin-backed stablecoin, grew by over 400%, from $1.25M in TVL at the start of the year to a peak of $6.72M. More importantly, the product performed as designed. The delta-neutral strategy generated positive funding on 84% of trading days, delivering 10.94% APY over the year. The system experienced zero incidents, even amid severe market stress, including the Bybit hack on 2/21 and the flash crash with mass liquidations on 10/10.

The simple, BTC-only design has stood the test of time and demonstrated strong resilience.

Transparency remained a core operating principle. We published monthly independent attestations from custodians Copper and Ceffu, confirming that USDh remained fully Bitcoin-backed throughout the year. Every report reached the same conclusion: reserves were intact, and the system behaved as intended.

As the market continues to evolve, a structural gap in DeFi has become increasingly clear; the absence of sustainable, transparent, Bitcoin-native yield.

In response, we have sharpened our focus on delivering institutional-grade Bitcoin yield within BTCFi, aligned with our broader mission of enabling global financial freedom.

hBTC is our first Bitcoin yield product. It’s Bitcoin that earns Bitcoin—self-custodial, transparent, and fully redeemable for native BTC. The codebase is complete, alpha testing is underway, and two independent third-party security firms have completed full audits.

hBTC will launch this winter. It’s just the first product in a broader Bitcoin yield suite.

2026 is about building Bitcoin yield end-to-end, grounded in the same core principles of sustainability, transparency, and institutional-grade risk controls.

Q3 State of Stacks

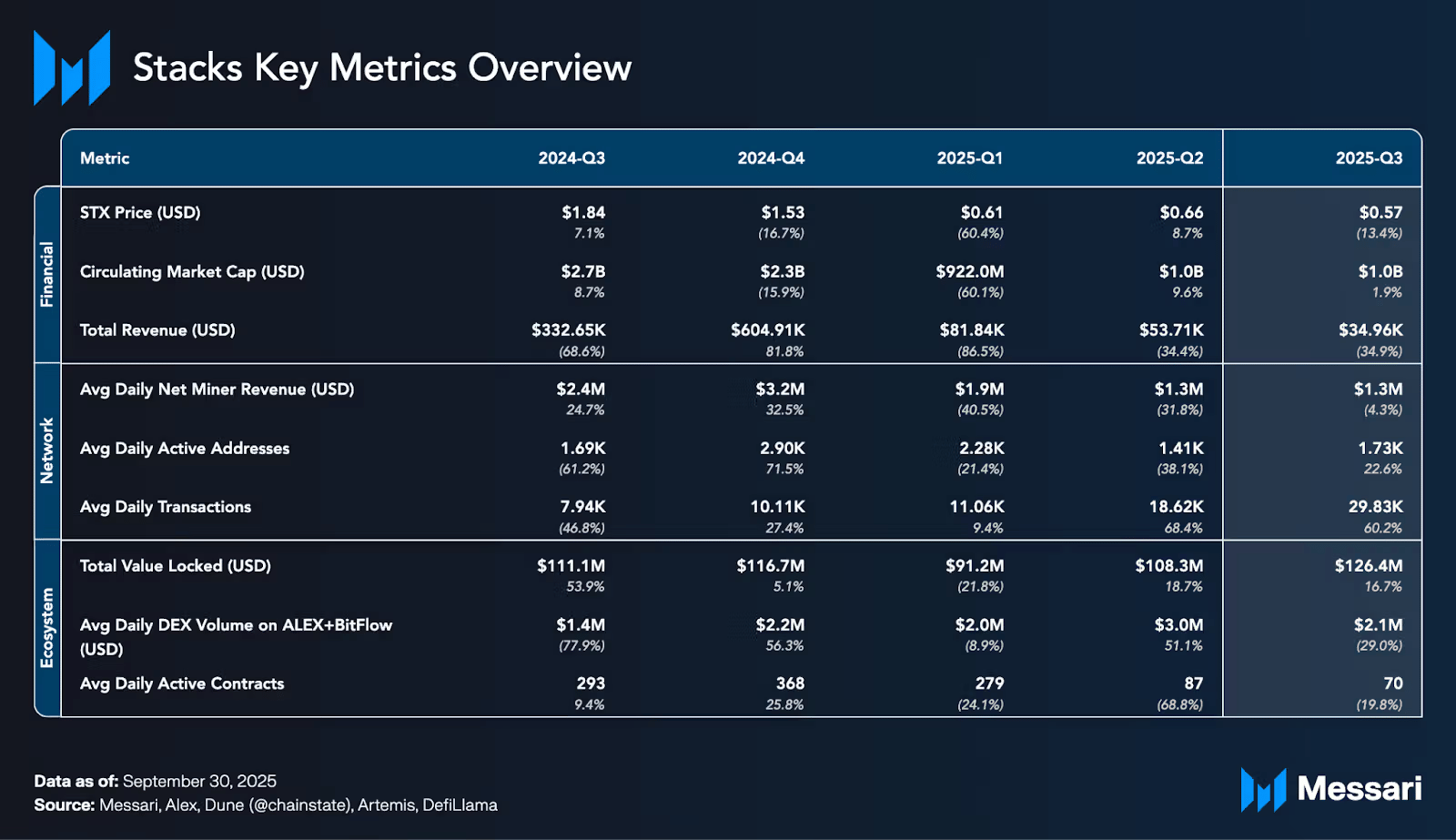

Messari published its State of Stacks Q3 2025 report, and the quarter told a story of usage on the rise. In contrast to prior quarters, Q3 saw a meaningful rebound in core network activity.

Key highlights from the quarter:

DeFi TVL increased from 150.3M STX to 221.1M STX ($108.3M to $126.4M in USD terms)

Total transactions grew 61.9%, rising from 1.7M to 2.7M

Average daily transactions increased 60.2%, from 18,622 to 29,828

We see a growing demand for Bitcoin-native applications, especially as the friction to onboard to BTCfi is removed.

Read the full report for a comprehensive analysis of Stacks in Q3, including ecosystem growth, usage trends, and the major milestones that shaped the quarter.

USDh Yield Recap

18% APY to start the year.

If "make more money" is your 2026 resolution, USDh is already working on it.

Market Review

Bitcoin is trading near $89,000 as we close the first week of 2026, with price action compressing between progressively lower highs and higher lows. This coiling structure reflects declining realized volatility amid thin holiday liquidity. Implied volatility also drifted lower over the period, falling roughly one-third from its November 21 peak of 62.21% to 42.40% today. Sustained declines in both realized and implied volatility often coincide with low-liquidity conditions and can precede a directional move.

The S&P 500 briefly reclaimed all-time highs in the days following Christmas for the first time since September before relinquishing those gains during New Year’s week. Technology stocks have shown relative weakness, with the NASDAQ posting its third lower high since its October 29 peak. Notably, both the NASDAQ and Bitcoin are now exhibiting similar coiling price structures.

Data Summary:

DVOL: 42.40%

Equal-weighted futures basis spread: 4.67% APR

Futures curve: Inverted contango from the front week onward

Perp funding rates are elevated compared to previous weeks

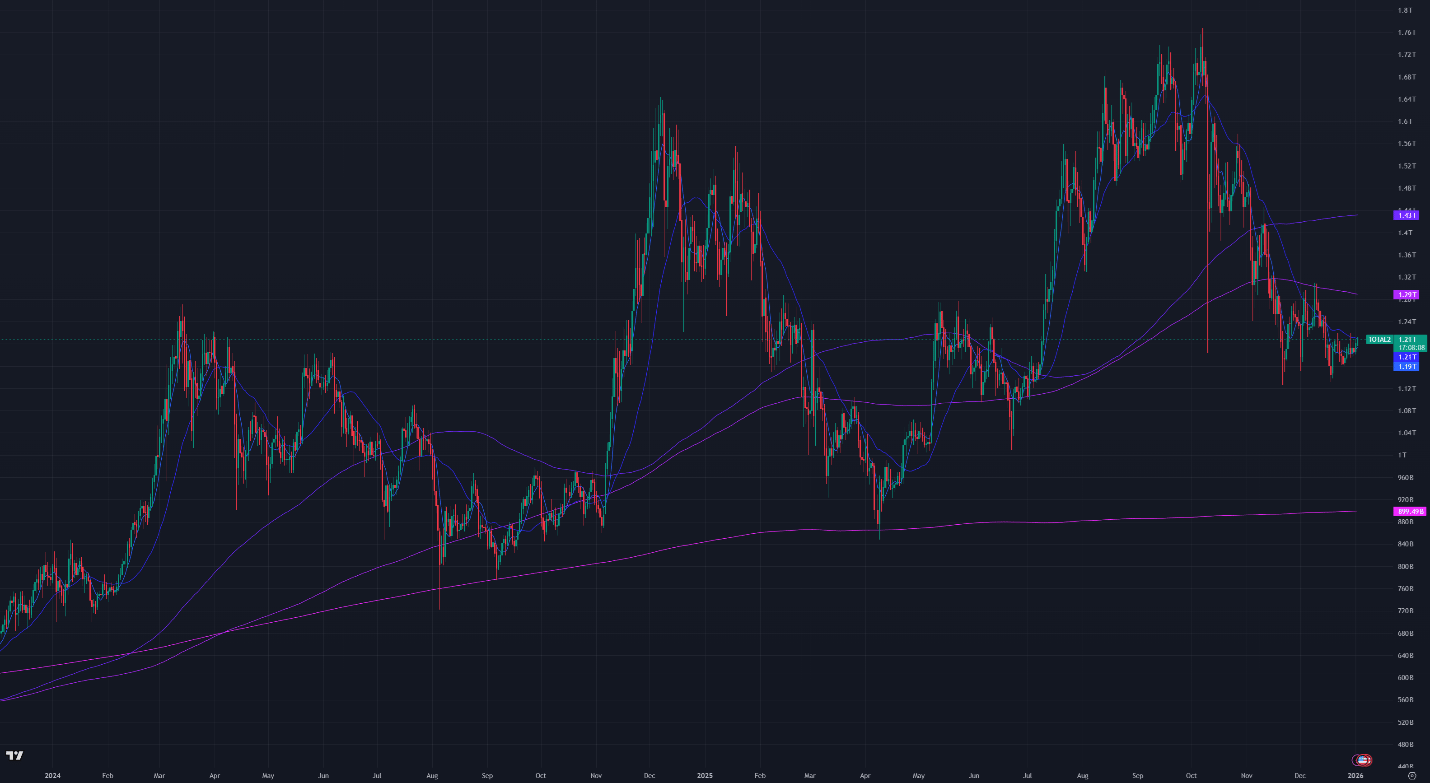

Aggregated altcoin market caps increased to $1.21T from $1.18T last week

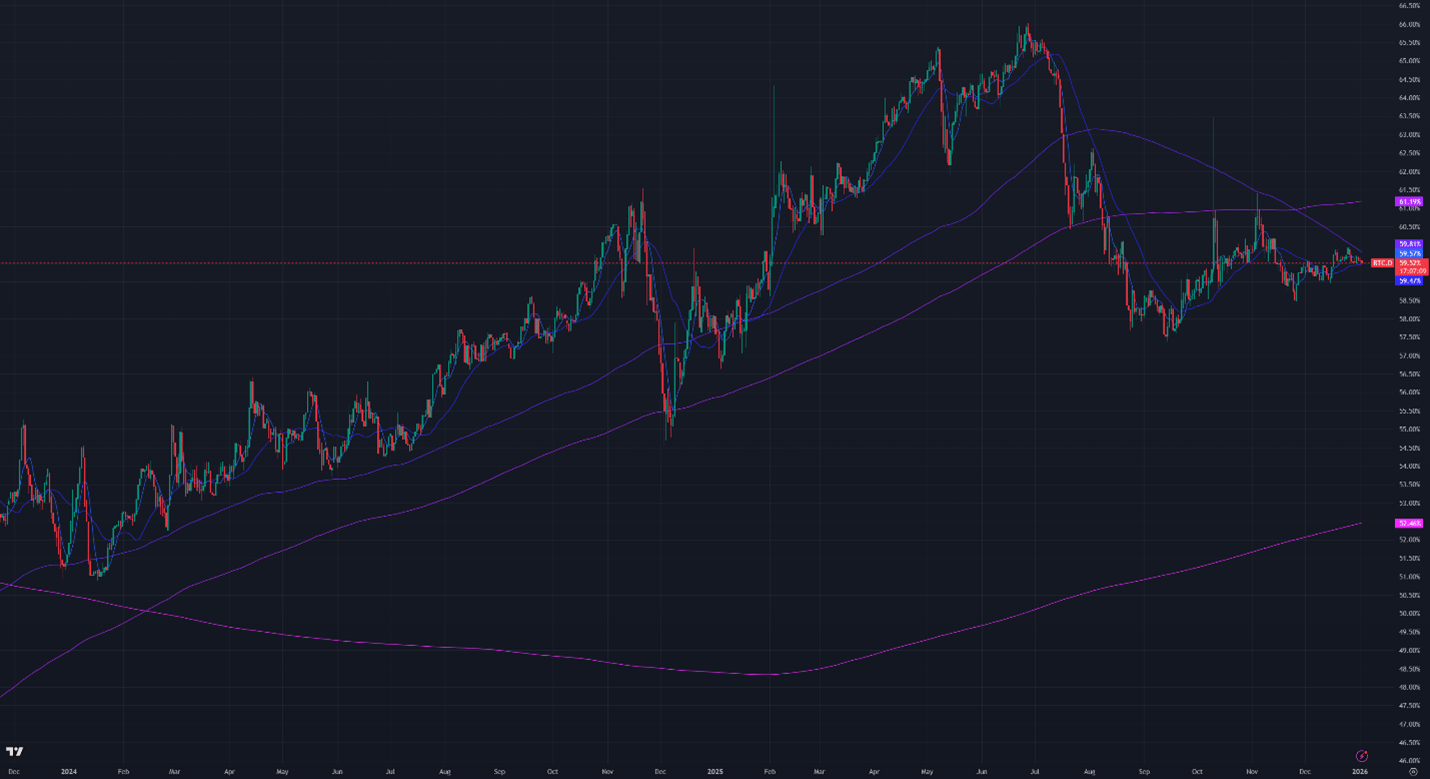

Bitcoin dominance declined 0.48%

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $89,000

7-Day MA: $88,200

30-Day MA: $88,800

180-Day MA: $106,900

360-Day MA: $101,600

200-Week MA: $56,900

Bitcoin is trading near both short-term moving averages, the 7-day and 30-day MAs. Price is no longer in a strong downtrend but remains below the 180-day and 360-day MAs, leaving the broader trend unresolved.

The current price near $89,000 sits within a technical support zone. Below this level, support areas are at $86,000, $80,000, $76,000, and $60,000, with the long-term 200-week MA near $56,000 historically marking cycle bottoms.

BTC ETF Flows

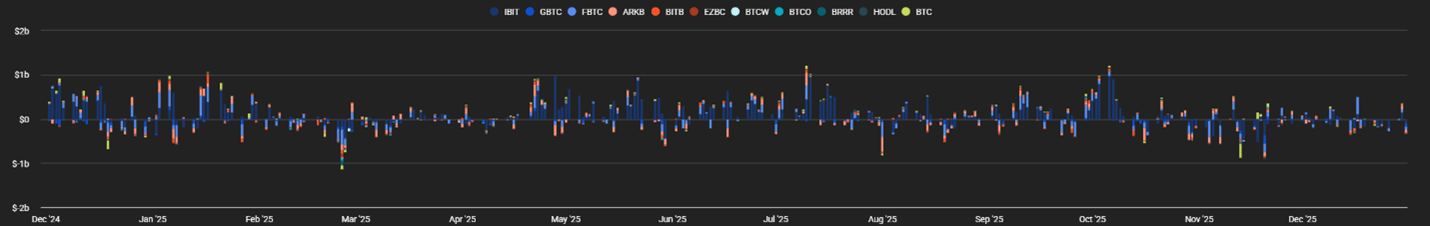

Net outflows totaled $288M this week. Flows have moderated since Thanksgiving, shifting from billions in outflows to low hundreds of millions in both inflows and outflows. As flows moderated into year end, realized volatility declined.

Figure 4: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) declined through the holiday period. DVOL is at 42.4%, down from 42.67% last week. Volatility has remained range-bound between the low 40% and low 50% levels since the October crash. Before the holidays, price action below $90,000 was consistently accompanied by implied volatility rising above 50%.

Implied volatility reached a two-year low in late September before the October–November sell-offs reduced options liquidity and briefly interrupted the 18-month downtrend driven by market-maker options hedging across Bitcoin-linked products such as ETFs, Bitcoin treasury companies, and miners. Volatility has since resumed its broader decline.

Figure 5: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

Basis Spread

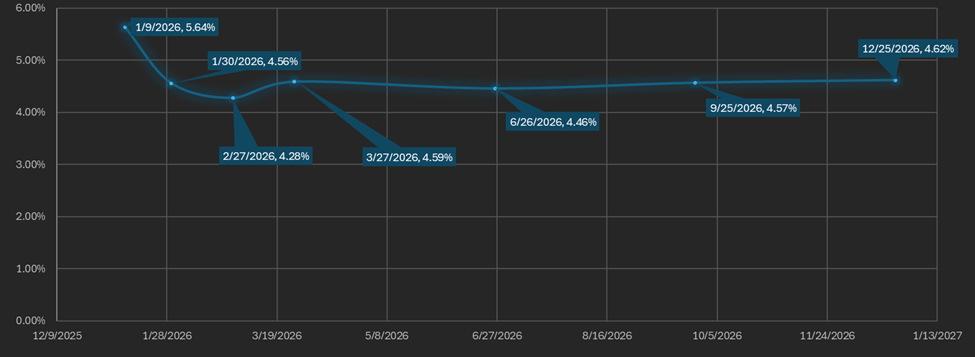

The basis spread, or the price of the futures contract over its spot price, is positive across all maturities. The equal-weighted average basis declined from 5.59% APR to 4.67% APR week over week.

The futures curve is now in very flat contango, with the front month (January 30) trading largely in line with the back month and later maturities. The spread between the lowest and highest yielding contracts fell from 1.63% to 1.36%, driven by larger declines in shorter-dated maturities.

Figure 6: Futures Curve; Maturity Date, APR %

Macro

On December 10, the Federal Reserve cut the federal funds rate by 25 bps to 3.50%–3.75%.

Precious metals, particularly silver, rallied through December, driven by physical demand tied to electronics and solar manufacturing in China. Despite frequent comparisons, Bitcoin and metals have diverged. As of January 2, 2026, Bitcoin and gold show a negative 30-day rolling correlation of roughly -0.66, near historical lows. In contrast, Bitcoin’s price behavior in the second half of 2025 has more closely tracked NASDAQ tech stocks than precious metals.

Sincerely,

The Hermetica Team