- Hermetica

- Posts

- Weekly Update - December 26, 2025

Weekly Update - December 26, 2025

Bitcoin Yield Is Almost Here — Waitlist Only

IN THIS ISSUE

❄️ Bitcoin Yield Is Almost Here

🪙 Wall Street Reprices BTC

💰 USDh Yield Recap

📈 Weekly Market Review

Jakob TL;DR

It’s winter, and I know you’re asking: where is hBTC?

The short answer is it’s almost ready. The long answer is that we’re code complete, security audits have concluded with no severe findings, and alpha testing is underway.

Self-custodial, on-chain, transparent Bitcoin yield is almost here.

As we approach launch, it’s great to see the growing demand for BTCfi infrastructure. The firms on Wall Street that once dismissed BTC are now moving toward participation, driven by client demand and clearer regulatory paths.

As the year comes to a close, I want to extend my best wishes to you. I’m grateful for the trust and the shared work throughout the year. I’m excited to continue pushing what’s possible on Bitcoin forward (but more on that later).

Bitcoin Yield Is Almost Here

Winter is here. Naturally, we’ve been getting the same question: Where is hBTC?

The answer: Almost here.

hBTC is ticking off milestones, and launch is close. We’re code complete and have completed two independent third-party audits with no severe findings. Testing is progressing smoothly: our internal test suite ran without issue, and alpha testing is now underway. We’ve been running the protocol for over a month, and all institutional-grade risk controls have performed exactly as expected.

We promised winter, and we keep our promises.

hBTC will be here soon and is exclusive to our waitlist. If you don’t want to miss out on your chance to earn self-custodial, on-chain, transparent BTC yield, then join the waitlist now:

Wall Street Reprices BTC

For years, Wall Street dismissed Bitcoin. Major banks kept it at arm’s length, warning it was too risky to hold on the balance sheet. Crypto was something to comment on, not participate in. Not anymore.

JPMorgan, the largest U.S. bank, with more than $3T in assets, is preparing to offer Bitcoin and crypto trading to institutional clients. It’s a notable reversal for a firm whose leadership spent years publicly criticizing Bitcoin.

JPMorgan isn’t alone. Across Wall Street, banks that once resisted crypto are beginning to accommodate.

Pressure works. Clients are demanding access. Regulators have clarified the rules. And the cost of staying out is beginning to outweigh the risk of getting involved.

Wall Street’s support is an early signal of a longer transition toward a global financial system increasingly built on, and earning from Bitcoin.

USDh Yield Recap

Your stablecoin can earn. Even during the holidays.

USDh gave 8% APY in week 52.

Market Review

Bitcoin reached a low of $84,500 last week and trades below the $100,000 highs seen in November. Five of the last eight Decembers have been negative for Bitcoin, contrasting with U.S. equities posting positive December returns 59% of the time. As ETF flows dominate Bitcoin price action lately, returns may more closely resemble equity return profiles. However, Bitcoin saw $664M in net outflows this week despite reduced market volume from the holiday.

The S&P 500 reclaimed all-time highs this week for the first time since September, while the NASDAQ remains 2% below its peak.

Data Summary:

DVOL: 42.67%

Equal-weighted futures basis spread: 5.59% APR

Futures curve is in an inverted contango from front week onward

Perp funding rates increased relative to previous weeks

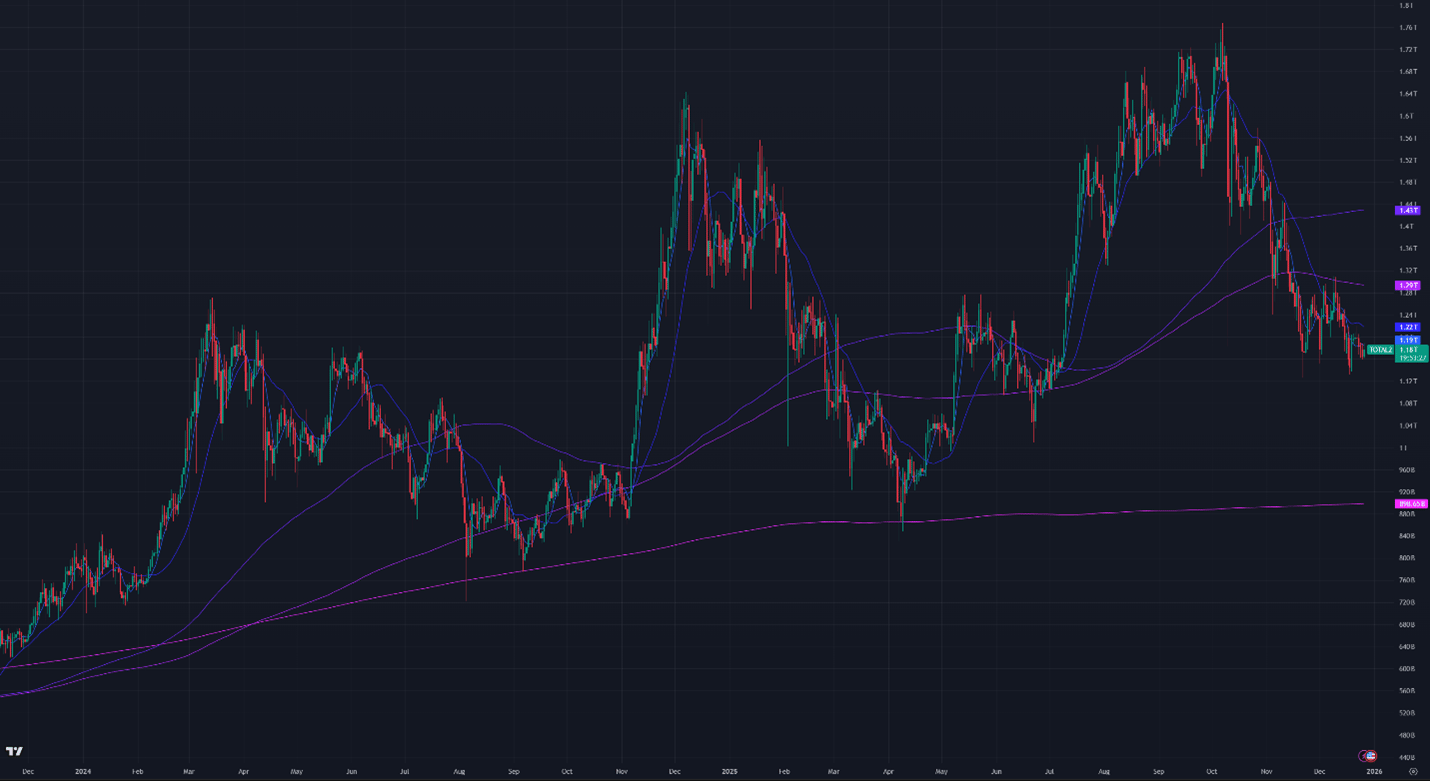

Aggregated altcoin market caps are down to $1.18T from $1.19T last week

Bitcoin dominance increased 0.37% this week

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $88,500

7-Day MA: $88,100

30-Day MA: $89,400

180-Day MA: $107,700

360-Day MA: $101,800

200-Week MA: $56,700

Bitcoin is trading near its 7-day and 30-day Moving Averages (MA), indicating the recent strong downtrend has paused. However, the overall trend remains uncertain as the price is still below the longer-term 180-day and 360-day moving averages.

The current price is within a technical support zone. Should the price drop below this zone, the next support levels are $86,000, $80,000, $76,000, and $60,000. Historically, the long-term 200-week moving average, currently $56,700, has marked cycle bottoms.

BTC ETF Flows

Net outflows totaled $664M this week.

Although flows reached a higher absolute magnitude than in the prior three weeks of December, overall activity has moderated significantly since Thanksgiving. Outflows that previously ran in the billions have eased, with both inflows and outflows now confined to the low hundreds of millions. With flows continuing to moderate, realized volatility may decline through year-end.

Figure 4: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) declined as prices dipped below $90,000, now at 42.67% after ending last week at 46.67%. Since the October sell-off, volatility has remained range-bound between the low 40s and low 50s. Earlier in the cycle, dips below $90,000 pushed DVOL above 50%.

Implied volatility reached a two-year low in late September. Subsequent market declines in October and November reduced options market liquidity and lifted volatility into its current range, interrupting a year-and-a-half compression contributed to by market-maker hedging. Hedging activity across Bitcoin-linked products such as ETFs, Bitcoin treasury companies, and miners systematically dampens implied volatility and shapes price behavior around option expiration levels.

Figure 5: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

Basis Spread

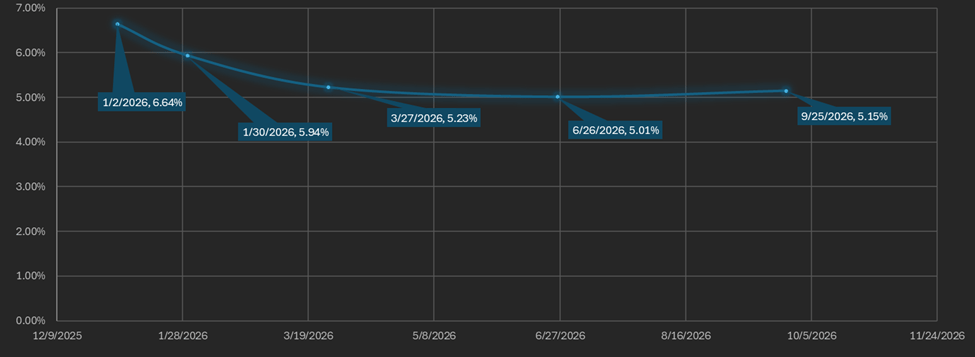

The basis spread, or the price of the futures contract over its spot price, is positive across all maturities. The equal-weighted average basis increased from 4.29% APR to 5.59% APR week over week.

The futures curve remains in inverted contango, with the front month (January 30) trading above both the back month and later maturities. The spread between the lowest and highest yielding contracts widened from 1.48% to 1.63%, driven by larger increases in shorter-dated maturities.

Figure 6: Futures Curve; Maturity Date, APR %

Macro

On December 10, the Federal Reserve held its eighth FOMC meeting of the year and cut the federal funds rate by 25 basis points to a target range of 3.50%-3.75%. The Bank of England also cut rates by 25 basis points, bringing the Bank Rate to 3.75%.

Sincerely,

The Hermetica Team