IN THIS ISSUE

🏆 Favorite Stacks Project 2025

🔓 Unlocking Yield

🪙 Bitcoin’s First Tier-1 Stablecoin

📈 Weekly Market Review

Jakob TL;DR

This week, I had a proud founder moment.

The Stacks community named Hermetica its Favorite Project for 2025. I take it as a signal that we’re pushing in the right direction and our mission is resonating with the people active in BTCfi.

That direction is making Bitcoin productive without breaking the Bitcoin standard. For a long time, BTC yield didn’t exist or came with tradeoffs. Things are starting to change as the missing pieces come together, something I talked about in depth in the Stacks Bitcoin Capital Markets webinar this week.

A big part of what’s changed is access to infrastructure and liquidity. Capital still lives in dollars, and on-ramps into BTCfi have been the bottleneck. This week, USDCx launched on Stacks, a step toward closing that liquidity gap.

Favorite Stacks Project 2025

The Stacks community has spoken: Hermetica is the favorite project for 2025.

Stacks is where Bitcoin-native finance is taking shape, and Hermetica is at the forefront of the shift toward Bitcoin as productive capital.

Thank you to everyone in the ecosystem who walked the journey with us. You’re the reason we’re building an on-chain suite of yield products powered entirely by Bitcoin.

With hBTC on the way, the year ahead will be even bigger.

Unlocking Yield

For the first time, the building blocks are in place to create a Bitcoin yield product and user experience that is completely Bitcoin-native.

Deposit, earn, and withdraw native BTC while enjoying the benefits of self-custody and transparency made possible on-chain.

This is only possible because we now have low-latency Bitcoin wrappers, BTCfi primitives, and yield sources like USDh.

Want to learn more about Bitcoin's move from a passive reserve to a productive on-chain earner?

Watch the recording of the Stacks webinar with Jakob to learn how hBTC is the answer to BTC-on-BTC yield and how it works.

Bitcoin’s First Tier-1 Stablecoin

What’s better than liquidity? More liquidity.

USDCx is live on Stacks as Circle launched its USDC-backed stablecoin on Bitcoin’s leading L2, extending its multi-chain dollar directly into BTCfi.

Most capital still lives in dollars, and most of those dollars live outside Bitcoin. The on-ramp into Bitcoin DeFi has always been a pain point.

USDCx removes that friction.

Capital can now move directly from USDC on any network to Stacks without a third-party bridge. Capital no longer has to detour through complex paths just to reach Bitcoin-native products.

Market Review

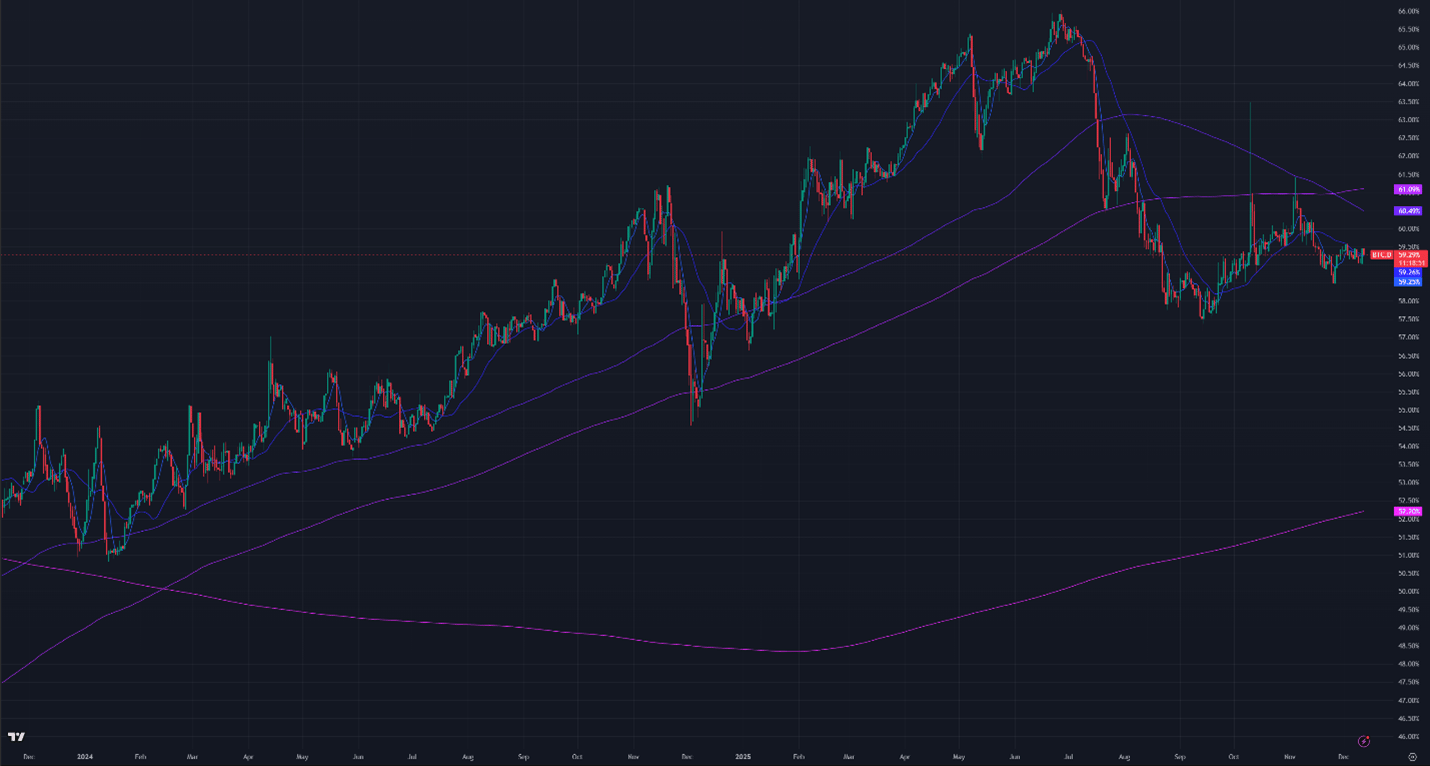

Bitcoin reached a low of $84,500 this week, trading below the $100,000 highs seen in November. Five of the last eight Decembers have been negative for Bitcoin, which contrasts with U.S. equities posting positive December returns 59% of the time.

Equities trade near all-time highs. The S&P 500 sits less than 1.5% below its peak, while the NASDAQ remains more than 2% off its highs. The tech and AI-led rally that began in April has slowed. Oracle, a data center and analytics company, faces financing constraints tied to debt-servicing concerns. Its largest financing partner, Blue Owl Capital, declines participation in future capital raises, and Oracle’s CDS spreads widen.

Oracle is the largest non-MAG 7 data center company in US markets, and its financing constraints have raised industry-wide concerns about the economics of large language model development. Current LLM providers operate without positive cash flow and rely on ongoing external funding from venture capital or parent companies, like Google. If funding conditions tighten, data centers that supply compute to LLM providers lose the ability to operate and service their debt. Failures at the infrastructure level propagate quickly through financing markets and could mirror the collapse of overbuilt telecom infrastructure in the early 2000s. A crisis of that scale historically coincides with broad weakness across risk assets, including Bitcoin.

Data Summary:

DVOL: 46.67%

Equal-weighted futures basis spread: 5.29% APR

Futures curve is in an inverted contango from front week onward

Perp funding rates are elevated compared to previous weeks

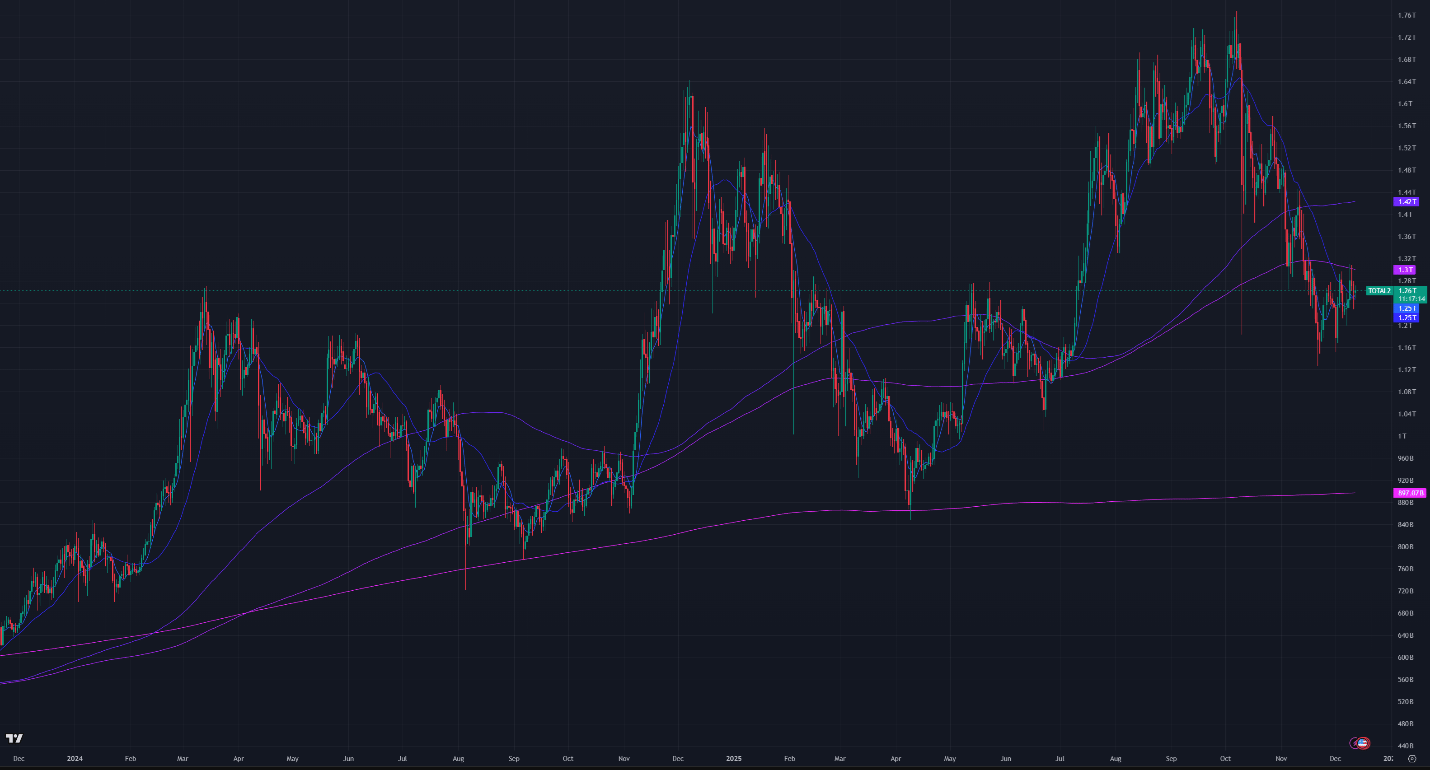

Aggregated altcoin market caps are down to $1.19T from $1.26T last week

Bitcoin dominance increased 0.34% this week, breaking the recent decline

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $88,200

7-Day MA: $87,500

30-Day MA: $89,200

180-Day MA: $102,000

360-Day MA: $108,400

200-Week MA: $56,400

Bitcoin is trading near both short-term moving averages, the 7-day and 30-day MAs. Price is no longer in a strong downtrend but remains below the 180-day and 360-day MAs, leaving the broader trend unresolved.

The current price sits within a technical support zone. Below this zone, support levels are at $86,000, $80,000, $76,000, and $60,000, with the long-term 200-week MA near $56,000 historically marking cycle bottoms.

BTC ETF Flows

Net outflows were $290M this week. Flows have moderated since Thanksgiving, shifting from billions in outflows to low hundreds of millions in both inflows and outflows.

Figure 4: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) rose over the past week as price moved below $90,000. DVOL now stands at 46.67%, up from 43.32% last week. Since the October crash, volatility has remained range-bound between the low 40% and low 50% levels. That range has historically broken during moves below $90,000, though it held this week as options positioning adjusted.

Implied volatility reached a two-year low in late September. Market declines in October and November reduced options market liquidity and pushed volatility into its current range, interrupting the longer-term downtrend that had persisted for roughly a year and a half.

That longer-term decline was driven by market-maker options hedging across Bitcoin-linked products such as ETFs, Bitcoin treasury companies, and miners. Hedging flows systematically compress Bitcoin implied volatility and influence price behavior around option expiration levels.

Figure 5: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

Basis Spread

The basis spread, defined as futures pricing relative to spot, is positive across all maturities. The equal-weighted average basis rose from 4.59% APR to 5.29% APR week over week.

The futures curve remains in inverted contango, with the front month (December 26) trading above both the back month and later maturities. The spread between the lowest and highest yielding contracts fell from 1.81% to 1.48%, driven by larger increases in longer-dated maturities.

Figure 6: Futures Curve; Maturity Date, APR %

Macro

On December 10, the Federal Reserve held its eighth FOMC meeting of the year and cut the federal funds rate by 25 bps to a range of 3.50%–3.75%.

During the October press conference, Powell emphasized that a December cut was not assured, prompting December SOFR futures to reprice lower. That uncertainty was driven by a prolonged gap in economic data caused by the government shutdown, which delayed releases for more than a month.

When the government announced in mid-November that October job data would be released without unemployment figures, rate-cut probabilities fell further. Prices stabilized later in the month following dovish remarks from senior Fed officials, including Chris Waller. As has been typical under Powell, policy expectations were effectively signaled ahead of the meeting, with December rate-cut odds nearing full pricing roughly one week before the decision.Sincerely,

The Hermetica Team