- Hermetica

- Posts

- Weekly Update - August 22, 2025

Weekly Update - August 22, 2025

Alpen Labs Releases Glock

IN THIS ISSUE

📰 Alpen Labs Releases Glock

🌐 LATAM Stablecoin Adoption Grows

💰 USDh Yield Recap

☎️ Hermetica Hangout: Arch Network

📈 Weekly Market Review

Like what you see? Follow us on X so you don’t miss any future announcements:

Alpen Labs Releases Glock

Alpen Labs introduced Glock (Garbled Locks for Bitcoin), a new cryptographic tool that enables optimistic verification of off-chain computation on Bitcoin.

With a 99.8% reduction in on-chain costs, Glock is a major step toward scalable, rollup-style Bitcoin Layer 2s becoming a reality.

At Hermetica, our mission is to help build a scalable financial system on Bitcoin, and we’re excited to see the Alpen team push the limits of what’s possible to bring that vision closer.

LATAM Stablecoin Adoption Grows

Dune’s LATAM Crypto 2025 Report shows stablecoins are driving payments, remittances, and inflation protection across Latin America.

In markets like Argentina, Brazil, and Colombia, stablecoins now surpass Bitcoin in transaction volume, making up over 90% of regional exchange flows.

We anticipate yield-bearing stables like USDh will be an attractive option for users looking to tap into the growing demand for stable assets.

USDh Yield Recap

Around here, a seat in the community comes with yield.

This week, USDh paid out 6% APY in dividends.

Hermetica Hangout: Arch Network

This week, we hosted Arch Network for a discussion on how they’re building infrastructure to scale Bitcoin DeFi. If you missed the session, catch the recording here.

Next week, join us for another session spotlighting builders pushing BTCfi forward. Set your reminder, you won’t want to miss it.

Market Review

Total crypto market cap corrects 3% with Bitcoin sinking to $113,000, its range low. Bitcoin had multiple failed breakouts above $120,000 in the last month and a half after breaking the previous all-time high of $110,000. Bitcoin dominance has dropped after each failed breakout.

Aggregated altcoin market caps fell from $1.61T to $1.54T this week. Bitcoin stayed nearly flat, declining only 0.01% and remaining below the 200-week moving average. Altcoins in aggregate have been perfectly correlated with Bitcoin this week, with a beta of 1.

• DVOL bounced off lows but remains in a downtrend

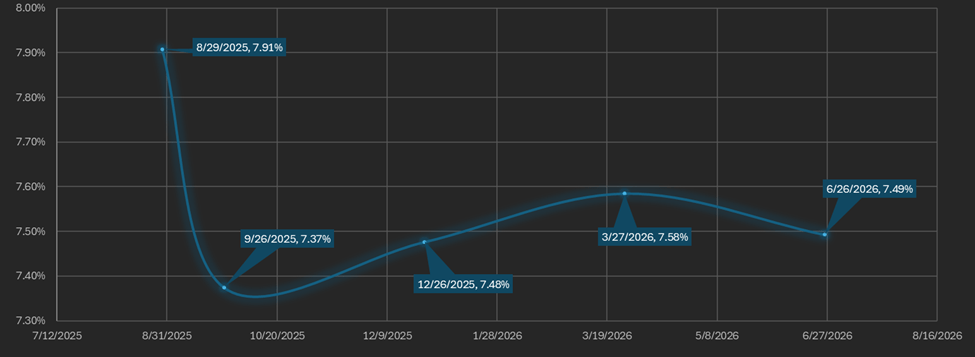

• The average equal-weighted futures basis spread is down 2.50% APR to 7.57% APR

• The futures curve fell across all maturities and is flat outside the front-week contract

• Perpetual futures (perps) funding rates were near zero all week, except for Wednesday and Thursday, when they peaked at 18.62.

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $113,300

7-Day MA: $114,900

30-Day MA: $116,600

180-Day MA: $101,000

360-Day MA: $92,300

200-Week MA: $51,700

Bitcoin remains below its 7-day and 30-day moving averages.

Trend Following

Returns for a Bitcoin 7-day and 30-day long trend-following portfolio are down 5.62% from January’s ATH. Three months ago, the portfolio was down 22.99%, marking the largest drawdown in long-oriented trend-following portfolios since late 2024, when they drew down nearly 25%.

Thursday morning, trend portfolios were flat from January’s ATH but lost over 4% after the Bitcoin ATH rejection two weeks ago. Bitcoin trend strategies face challenges as prices stagnate between $110,000 and $120,000.

Figure 4: Bitcoin 7 & 30-day Trend Following Strategy Returns

BTC ETF Flows

Net outflows totaled $1.17B this week, a $1.61B drop from last week’s $442M inflows. Ethereum ETF outflows matched the trend in Bitcoin, with $638M in outflows.

Figure 5: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) has risen to 37.34% from an early August low of 34.35%. Despite this increase, current DVOL levels are the lowest observed since September 2023.

TradFi Bitcoin products, like ETFs and BTC-portfolio companies, are increasingly selling call options for yield, creating systemic downward pressure on options prices and implied volatility. Yield Max ETF ($MSTY) alone sells $4.5B in calls on Strategy stock monthly and quarterly, while hundreds of hedge funds do similar trades on miners and Bitcoin ETFs. Market makers hedge by offloading similar calls on Deribit, keeping DVOL capped even as rising prices should trigger more aggressive delta hedging.

Figure 6: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

Basis Spread

The basis spread, or the price of a futures contract over its spot price, is positive across all maturities. The average (equal-weighted) basis spread was down 2.5% APR, from 10.07% APR to 7.57% APR.

The futures curve is in a flat inverted contango, with front weeks trading above later maturities. There is a 0.53% spread between the lowest and highest yielding maturity, and a 0.21% spread when the front-week maturity is removed from the average. This is the flattest curve in our data

Figure 7: Futures Curve; Maturity Date, APR %

Macro

On July 30, the Federal Reserve held its fifth FOMC meeting of the year. Chair Powell neither cut rates nor reduced quantitative tightening from the $5 billion level set in March, maintaining the current stance and noting ongoing uncertainty around inflation. President Trump is finalizing trade deals that may ease economic uncertainty. December SOFR futures now price in only a 25-basis-point cut by year-end.

The European Central Bank cut rates by 25 basis points on June 6 but has not cut again, even with greater clarity on its trade deal with the United States. The Swiss National Bank also cut by 25 basis points to 0% in June, while the People’s Bank of China held steady. The Bank of England remains the only major central bank to cut rates since June.

The Dollar Index ($DXY) sits at 98.83 as of Thursday evening, near 3-year lows. 30-year Treasury yields, which peaked at 5.15% on May 22, a level last seen at the end of the 2023 rate hike cycle, are now at 4.92%, still near multi-year highs. Through Q2 and early Q3, rising long-term Treasury yields paired with a weak $DXY signaled foreign investors diversifying away from US markets, but recent trade deal announcements suggest this trend may be reversing.

Historically, $DXY and US Treasury bond yields have maintained a strong positive correlation. Figure 8 demonstrates the relationship between the relative value of the dollar (DXY) and US Treasury bond yields.

Figure 8: DXY Index returns (Purple), 30-year T-Bond yield returns (Blue), and 10-year T-Bond yield returns (Red), 3 years

Both equity market implied volatility (VIX) and US Treasury bond implied volatility (MOVE) are near their long-term steady states. The impact on equity IV from the Middle East conflict was mild, and when it ended, the VIX fell to new lows. The VIX is currently 16.59, up from 14.82, while the MOVE index is currently 80.52, up from 76.77.

Figure 9: VIX, Daily Candles; 2 Years

Figure 10: Move Index, Daily Candles; 2 Years

Sincerely,

The Hermetica Team