Bitcoin has entered a new phase of its lifecycle.

It has matured into a trillion-dollar asset class that is increasingly held by institutions. Spot ETFs, corporate treasuries, asset managers, and even sovereign entities now treat Bitcoin as a strategic asset for the balance sheet. For institutional allocators, Bitcoin is no longer peripheral. It is treated as a long-term portfolio holding.

Despite this progress, a structural gap remains. Bitcoin lacks reliable, institutional-grade yield on-chain.

Within Ethereum’s on-chain economy, capital is actively deployed into DeFi markets. As of 2025, approximately $72B of value is locked in Ethereum-based DeFi protocols, where capital is deployed across lending markets, automated market makers, derivatives venues, and structured strategies that generate ongoing yield.

TradFi offers an even clearer benchmark. Corporate cash is never treated as inert capital. Global non-financial companies hold more than $8T in cash reserves, yet these balances are not sitting in checking accounts. They are systematically deployed into safe yield-bearing instruments. Apple, for example, holds over $125B of its cash in marketable securities such as U.S. Treasuries and high-grade bonds, with only a small fraction maintained as true cash. Applied to the global cash stock, this implies that roughly $6T to $6.5T of corporate capital is continuously earning yield. In TradFi, capital that does not earn is considered misallocated.

Bitcoin, by contrast, earns nothing.

Although BTC is now a $2T+ asset class with institutional-grade custody and balance-sheet adoption, its capital remains largely idle. Only around 0.8% of Bitcoin supply is currently deployed in DeFi or yield-generating structures, representing well under 1% of Bitcoin’s market value.

Lessons From Bitcoin Yield Primitives

The industry’s first attempts to solve this problem ended poorly.

The first Bitcoin yield platforms failed by design. Celsius, BlockFi, and similar products promised yield while hiding the risk required to generate it. Returns were driven by leverage, rehypothecation, and counterparty exposure that users could neither see nor underwrite. When market conditions changed, the abstraction collapsed and Bitcoin principal was lost. The lesson was clear: risk that is not surfaced will expand, and yield that cannot be underwritten will eventually destroy capital.

In response, a second generation of Bitcoin yield products emerged with a different philosophy. Protocols like Babylon and CORE emphasized custody preservation, minimized counterparty exposure, and prioritized verifiability. While this shift was directionally correct, it revealed a different limitation. Yields that eliminate risk tend to converge toward zero, with Babylon yields falling below 0.1%. Capital remained safe, but largely inactive. In practice, many of these approaches generate negligible returns, insufficient for institutions seeking meaningful capital efficiency. The pendulum had swung too far in the opposite direction.

Risk Controls & Transparency are the Product, not Yield

Hermetica operates in the space between these two extremes.

Transparency-first philosophy informs every aspect of our design. Institutional-grade Bitcoin yield requires that users understand the specific risks introduced by each yield strategy, why those risks exist, and how they evolve. Exposure must be observable, mechanisms verifiable, and assumptions testable in real time. Transparency is not a feature; it is a design constraint.

This approach naturally leads to conservative, long-term strategies that prioritize durability over return maximization and focus on minimizing blow-up risk rather than chasing headline yields.

We see strong demand for this approach across the entire spectrum of Bitcoin holders. Institutions holding BTC on their balance sheetsand a broader cohort of Bitcoin-native users share the same unmet need: productive Bitcoin exposure that does not require trusting opaque intermediaries or risking principal.

Proof in Practice

Transparency-first design isn’t theoretical. We tested it in live market conditions throughout the entirety of 2025.

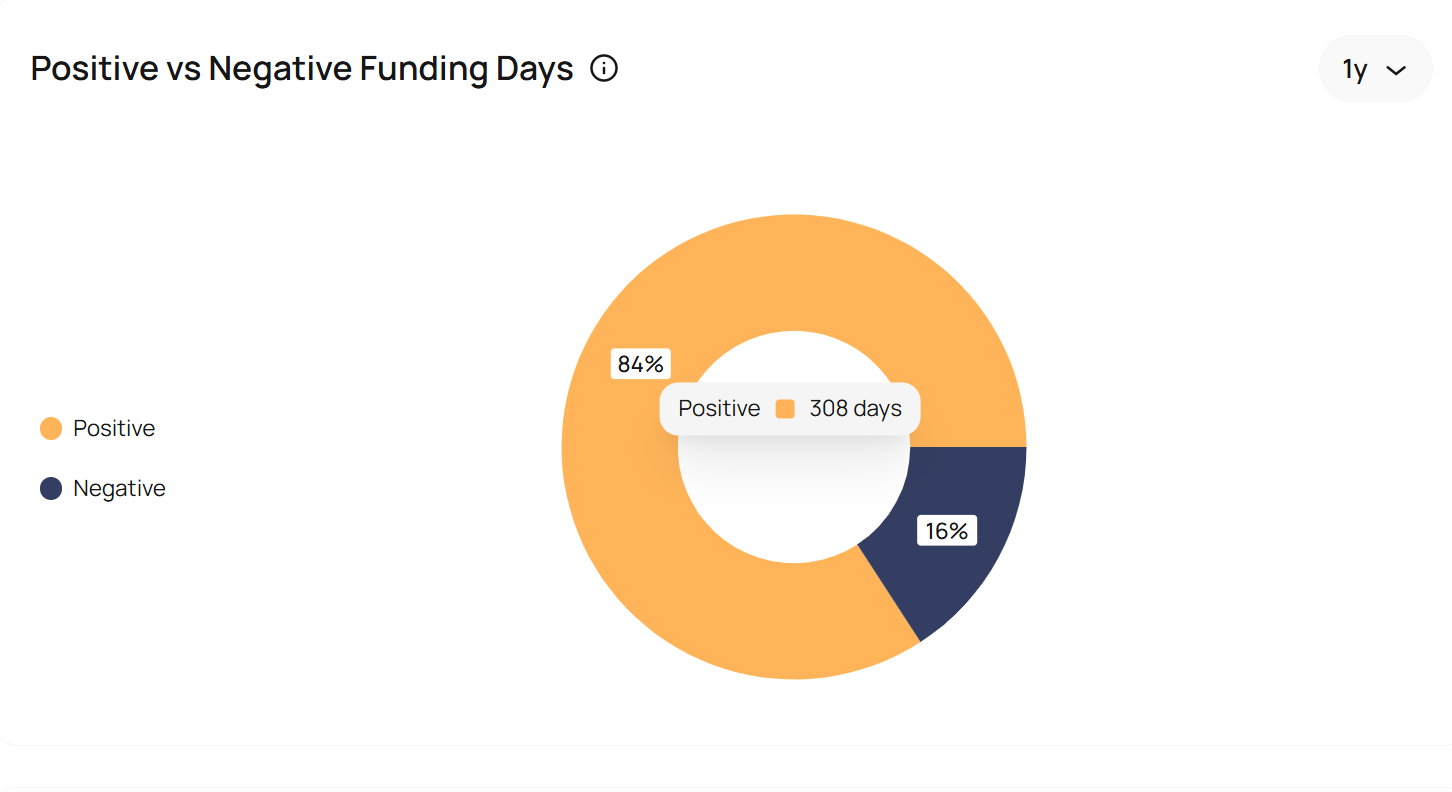

USDh, Hermetica’s Bitcoin-backed, yield-bearing stablecoin, increased TVL 400%+, the underlying delta-neutral strategy generated positive funding on 84% of trading days, and produced a 10.94% annualized return over the period.

Importantly, the system experienced no loss events, even during periods of pronounced market stress. This included the February 21 Bybit security incident and the October 10 flash crash that triggered widespread forced liquidations across the market.

Monthly independent attestations from custodians Copper and Ceffu verified that USDh remained fully backed at all times.

All of these metrics were available in real time and could be independently verified at any moment. Users were able to continuously underwrite the risk themselves, with full visibility into positions, exposures, and backing.

Institutional-Grade Bitcoin Yield

2026 will be the year we bring several Bitcoin yield products to market.

The first is hBTC - Bitcoin that earns Bitcoin; self-custodial, transparent, and fully redeemable for native Bitcoin.

It generates BTC-denominated yield from the most robust on-chain yield sources available today, while giving users full visibility into how that yield is produced.

The protocol operates entirely on-chain. All risk factors and risk controls can be independently verified and underwritten at all times. The system is comprehensively laid out in the Hermetica documentation - no black boxes.

hBTC is launching this winter, and it will set a new standard for Bitcoin yield products.

In parallel, we are developing a second Bitcoin yield product that brings a different set of yield sources on-chain. This product is currently in stealth, and we will share more details as it approaches launch.

2025 changed the landscape; the broader industry has entered a new regime. Crypto markets have matured and are now being adopted by institutions and the general public alike.

The era defined by opaque leverage, excessive speculation, and repeated blowups is ending. The future of on-chain finance is transparent and risk-adjusted, and conservative—aligned with the core principles that made Bitcoin credible in the first place.

We’re building this future, and we look forward to bringing it to market in the year ahead.